Financial Planning Blog

It may come as a shock to you, but apparently some financial advisors have made mistakes with their own money. Some will even admit to their financial blunders--to family, friends, colleagues, or even clients. However, a financial advisor with an inclination to own up to his errors in personal financial management should probably think twice before coming clean in a New York Times article. Just ask Carl Richards.

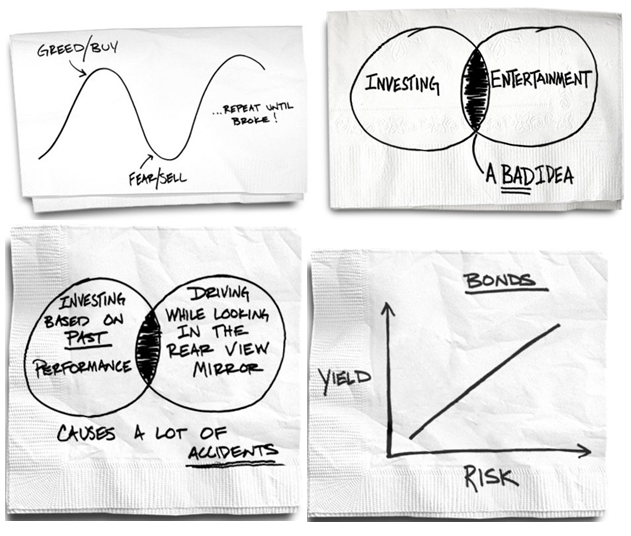

Carl Richards is a Certified Financial Planner and investment manager in Park City, Utah (formerly located in Las Vegas, Nevada). He has developed quite a following for his "personal finance on a napkin" sketches and his personal finance blog posts at New York Times. (I truly look forward to seeing the latest sketch each week. But, really...who has time to read financial planning blogs?)

Experience is a hard teacher because she gives the test first, the lesson afterwards. -- Vern Law*

Richards' story is similar to millions of Americans'. He bought too much house in Las Vegas during the boom years. They borrowed too much off the equity to fund his business start-up, and live a bit better than they could really afford. After considerable soul searching, they stopped paying on the underwater home they could no longer afford, and eventually arranged for a short sale. You can hear Carl tell his story on a recent NPR Planet Money podcast.

Judging by the reader comments on the original article, Richard's struck a raw nerve for many people. Many cannot understand how a financial planner could make such mistakes, and still be an advisor. For example:

- "This article is incredible. The author isn't competent to manage his own financial affairs, and his job is advising other s how to manage theirs?"

- "The Times reaches a new low in the quality of its financial writers, and that's saying something. It's like it's a Times job requirement for them to manage their personal finances like a 7th grader."

- "The notion that Richards was, and still is, a financial advisor is an indictment of the entire industry. He is clearly incompetent. He made foolish choices based on avarice and now seeks to justify them."

- "My mechanic has more common sense about Finances. (No offense to my mechanic!) Wanna bet his next book and article is 'How I lost my Financial Business when I wrote about how stupid I was with my own Personal Finances in the NY Times'".

That is just a sampling of the negative comments fit to print. To be sure, there were also a number of readers who expressed positive sentiments. Many readers simply took the opportunity to tell a bit of their story of how the real estate downturn had affected them. And, a surprising number of humble folks took the time to explain how they were much better managers of their finances, much too wise, and much too moral to get caught in such a reckless fiasco.

Financial professionals have been debating the wisdom of Richard's mea culpa. Some believe he has harmed the profession and undermined the credibility of financial planners with the public. (Frankly, is that even possible?) Others see it as a breath of fresh air, and the start of number of useful conversations of how we all do stupid things with money, and how to avoid repeating them. I'm in the latter camp. The whole controversy has reminded me of the many mistakes I have made over the years, and how they have shaped the advice I give today. Just a few examples:

- I was in too big of a hurry to buy a house. I basically borrowed 100% at interest rates well above 10%. (It was the early ‘80s.) We should have been more patient, saved up a decent down payment, and waited for interest rates to drop to affordable levels.

- I didn't have the first house sold before starting to build the second house. It didn't sell, and we became accidental landlords. After a few years, we were able to finally sell, almost breaking even. Coming from California, I didn't realize you could lose money on real estate until then. Thankfully, my lesson was much less expensive than Carl's.

- While juggling two house payments, we had another child and I took a cut in pay due to the recession. We found out those house payments don't necessarily become easier over time. I discovered the wisdom of sufficient margin between your house payment and your income.

- Even though we had two children depending on us, we never had a will in place until much too late. We had plenty of excuses, but in retrospect this was really irresponsible.

- Too little life insurance. Too little emergency savings. Too much company stock. Too much stock in general.

- And, yes, even though I advise my younger clients not to do it--I borrowed money to buy cars. (It would have been easier to save up for them if I hadn't been paying on two houses. One mistake begets another.)

"Experience is a brutal teacher, but you learn. My God, do you learn." - C.S. Lewis

It just could be that our ability to learn from our own mistakes, and the mistakes of others, is the best thing financial planners have going for them. I thank Carl for encouraging me to reflect upon my past experiences, and reminding me to not be so darn smug and self-righteous about the "right way" to handle personal finances. Hopefully, financial advice delivered with a little more humility and a lot more understanding will be more acceptable, and ultimately more effective at improving the lives of clients.

------------------------------------------------

*Yes, the Vern Law from Meridian, Idaho. The Cy Young Award winning pitcher with the Pittsburg Pirates is also credited with saying, "A winner never quits and a quitter never wins." Who knew? I thought Coach Manship at Ladera Vista Junior High made that up.

The most common way that a person works with a fee-only investment advisor is through an investment management relationship. The advisor and the individual (or couple) work together to formulate an appropriate investment strategy, and responsibility for the implementation of the strategy is delegated to the investment manager. The advisor receives trading authority in the client's accounts and executes the required transactions. Monitoring the portfolio and regular reviews are part of the arrangement, as are (in most cases) other financial planning activities. The advisor is generally compensated with an on-going, asset-based fee, although sometimes it is a flat retainer fee.

Table Rock Financial Planning and other members of the Garrett Planning Network will also provide fee-only investment advice on an hourly or project basis. (Other advisory firms will also work on an hourly basis, but they are the exception, not the rule.) Under this model, the advisor works with the client to develop and document an asset allocation strategy, and recommends appropriate investments. However, the client is responsible to implement the plan--buying and selling the recommended securities and monitoring their own accounts. Usually the client returns to the advisor for regular check-ups where the plan is reviewed, accounts are rebalanced, and revisions to the plan are made. Other financial planning topics are usually discussed, and like the original engagement, these check-ups are billed on an hourly basis.

With an investment management relationship you will likely pay higher fees--compensation for the additional responsibilities the manager shoulders, often a higher level of value-added service and potentially a closer relationship. The hourly model, where you take more responsibility for implementation, will usually be lower cost. At Table Rock Financial Planning, you can receive competent, objective investment advice either way. You get to decide which model is a better fit, and establish a relationship that best meets your needs.

Four Key Reasons to Choose Investment Management

"The investor's chief problem-even his worst enemy-is likely to be himself."-Benjamin Graham

At Table Rock we believe that investors can be successful under both the hourly or investment management model. We recognize that the hourly model is clearly preferable and more affordable for many individuals. However, there are also people who would be better served with an investment management relationship, where they delegate day-to-day responsibility for their portfolio. Before you decide which is best for you, consider the following reasons where an investment management arrangement may be preferable:

- Implementation follow-through: You have taken the time to meet with your advisor and formulate an asset allocation and investment plan that is designed to help you meet your financial objectives. Under an investment management relationship, the investment advisor will immediately begin implementing the plan with an experienced hand--after all, this his or her full-time job. Alternatively, if you have retained the responsibility for implementation, will you get after it promptly? Or, will the plan get laid aside for implementation when you have more time, or the mood suits you. One of the biggest disappointments of hourly planners is working with clients to develop a sound investment plan, only to find out the individual waited months to implement it, or worse, never fully followed through. It is like a doctor diagnosing a patient and writing a prescription that is never filled.

- Your time is an investment: You have only so many hours in a day. Do you have the available time to execute your investment plan--recognizing that some effort is usually necessary during normal working hours? Whether it is work, play, education, service, or spending time with family, most of us have high value activities we would rather invest our time in. Because we recognize the value of our time, we routinely pay others to do tasks we could do ourselves (e.g. housekeeping, lawn care, and cooking to name a few). I could have built my fence recently, but chose instead to delegate that work to a qualified contractor. This freed up my time to work at my profession and mountain bike.

- Interest and capability: Do you have a reasonable level of interest in working on your investments? Do you feel confident you can implement the plan without significant errors or stress? Some people do feel empowered and capable implementing their investment strategy. It is OK if aren't one of them. However, if you lack the interest or confidence to do the job, it is time to consider delegating the responsibility to a capable investment manager.

- Emotional endurance: Market volatility can take its toll on our emotions. It takes resolve to stay with an investment strategy, and one of the key roles of an advisor is to maintain a clear head and steady hand. You are paying the advisor to follow the plan--to keep his wits when all around seem to be losing theirs. Without the advisor in the driver's seat, will you be tempted to deviate from your investment strategy? Will you sell out after market drops, or chase the latest investing fad? Will you have the steadfastness to rebalance your portfolio--selling high and buying low? Investor discipline and behavior are critical to long term portfolio performance. Many people behave much better, not to mention sleep much better, when they delegate the day-to-day management of their investments.

Financial planners are always encouraging our clients to be informed, disciplined consumers. The question isn't whether investment management will cost you more in annual fees. The question is whether you will be better off, financially and emotionally, if you delegate the day-to-day management of your portfolio. As noted behavioral finance professor Meir Statman said, "Paying someone 1% a year to keep you from making 1.5% worth of mistakes can make a lot of sense." Truth is you shouldn't have to pay 1% per year to manage even a moderately sized portfolio, and the opportunity for the DIY investor to underperform is very high.

You decide--will investment management provide a good value for you?

Many people recognize a need for trustworthy, objective counsel in their personal finances, but never seem to get connected with the right advisor. If you are one of those people, you may appreciate the following blog posts by Michael Goldman of Wealth Gathering. At Wealth Gathering, Michael employs a unique approach to assisting people manage their money--it is essentially a fitness program for your financial life. If trustworthy and affordable financial coaching in a supportive on-line community sounds appealing to you, check out Wealth Gathering.

In Michael's first article he identifies Five Problems with Financial Advice--obstacles that stand in the way of people connecting with the right type of financial advisor. Despite these stumbling blocks, most people still need help--addressed in Five Reasons Most People Need Financial Advice. Finally, Michael provides some useful suggestions in Finding the Right Advice for True Financial Fitness, including personal financial coaching through the Wealth Gathering community or through the advisors of the Garrett Planning Network.

As Michael concludes, "Thinking you can get by with poor money habits and somehow catch up later is a proven formula for failure. The best time to start practicing wealthy habits is today and every day. So learn the basics and get started." Whether you find the right type of financial advisor for some personal coaching, set out on some serious self-study, or find a like-minded community like Wealth Gathering, it's time to get moving toward true financial fitness.

There is no getting around the fact that personal finances can get downright complicated. Retirement accounts, Social Security, insurance, paying for college, and investments are all complex. Making your retirement nest egg last over an uncertain lifetime is a thorny issue. And, if your eyes haven't glazed over yet, you still have taxes and estate planning to consider.

That is why I respect people who can cut through the difficulties and make some big concepts simple. Let me direct your attention to a couple of guys I really appreciate.

Carl Richards' BehaviorGap.com

Carl Richards is a Certified Financial Planner and investment manager (Prasada Capital Management) who knows how to keep it simple. He started writing about what he calls the Behavior Gap--why the average individual investor tends to do so much worse than the overall market performance. His blogs are insightful, but what is truly remarkable is his ability to reduce the complex topics of investor behavior and our relationship with money down to a sketch on back of a napkin. A few of my favorite examples are shown below, but you are encouraged to check out the BehaviorGap.com website and subscribe sign up for his newsletter. Also, you can check out his blog, including past articles and sketches at the New York Times Your Money section.

Sketches by Carl Richards

Bill Schulthieis' The Coffeehouse Investor

The Coffeehouse Investor is both a website and a short, easy to read book by Bill Schultheis, a Seattle area investment manager (Soundmark Wealth Management). The subtitle is: How to Build Wealth, Ignore Wall Street, and Get on with Your Life. What I like most about the Coffeehouse Investor is the attitude--ignoring the hype of Wall Street and getting on with our lives. We can make things much more complicated, but you will do well to follow The Coffeehouse Investor's three principles of investing:

- Save for a rainy day. (Develop a long term financial plan)

- Don't put all your eggs in one basket. (Diversify in different asset classes.)

- There is no such thing as a free lunch (Capture the entire return of each basket, or asset class, through low cost index funds).

Sure, this isn't all there is to know about investing or personal finance, but it's a big part of it. And, if you don't build a foundation on solid principles like these, the rest isn't going to matter. Check out the CoffeehouseInvestor website and sign up for the e-newletter. (Too bad he doesn't have any cartoons.)

It's official--Fools love the Garrett Planning Network.

Many of you are familiar with The Motley Fool, the popular investing website founded by brothers David and Tom Gardner. Besides the practical and amusing investment and financial planning content on the website, the Motley Fool champions shareholder values and advocates tirelessly for the individual investor. The Motley Fool also offers a large number of premium services for hundreds of thousands of subscribers.

The Motley Fool has long been a fan of the Garrett Planning Network's approach to fee-only financial planning, with the mission of making competent, objective financial advice accessible to all people. Recognizing the great need among the Motley Fool community for more hands-on help managing life's complex decisions, The Fool felt it was the time to kick off a search for a well-established, like-minded outfit with similar values with which to partner. They, of course, found a match in the Garrett Planning Network. They know the planners in the Garrett network offer the same kind of trustworthy, objective and transparent advice that The Fool has built its business on.

Check out You Need a Financial Advisor by Robert Brokamp, who writes the Motley Fool Rule Your Retirement newsletter. The Fool is a big advocate of DIY investing, but Brokamp points out why many of us need a financial advisor, even if we don't want to hand over management of our portfolio. He says:

We know we could handle all the aspects of our finances on our own; we may even think we should handle it all on our own. But we never get around to it. We have too many other things to do ... or we convince ourselves we do. ("I know I should create a budget, but my kitchen cabinet's a disaster!")

We firmly believe that you can learn all you need to know about personal finances. It just takes time (and a little curiosity about the topic helps). But if you find that you're just not getting around to taking care of business, then get an advisor. The money you pay her will be worth the bigger nest egg, reduced debt, lower taxes, sufficient insurance, and peace of mind.

But he points out, "This is all predicated on finding a good financial advisor." He goes on to discuss the inherent conflicts of interest if you hire advisors (i.e. "sales folks") who are paid via commissions--something every Fool knows. What follows is a discussion of the Motley Fool's partnership with the Garrett Planning Network and what you should expect from working with a Garrett planner, such as Table Rock Financial Planning.

While you are out at the Motley Fool site, take time to read Sheryl Garrett's recent article on why the fiduciary standard matters. Although financial services lobby may be successful in staying off needed regulatory reform requiring everyone providing investment advice to be held to a fiduciary standard (including stock brokers and insurance representatives), remember that Table Rock Financial Planning, along with the rest of the Garrett Planning Network, have always been committed to a fiduciary standard. Sheryl relates a great story on why you deserve an advisor who is looking out for your best interests.

Sheryl Garrett, founder of the Garrett Planning Network, was recently featured in the New York Times "Your Money" column. She was an obvious choice for this discussion about how much advice people need, how it should be delivered, and how much they should pay. (There is an accompanying podcast with the author, Tara Siegal Bernard and the Times personal finance columnist, Ron Lieber.)

The gist of the article and podcast is that most people need financial advice, at least at some points in their lives. For wealthy people, this is not an issue, and they are used to paying significant sums for financial advisors who are basically on some sort of retainer. But, those with fewer resources still have a number of places to turn to, and many of these are discussed. (A great option for many, of course, is to find an hourly, fee-only financial planner from the Garrett Planning Network. In Idaho there are two Garrett Planning Network firms--Table Rock Financial Planning in Boise, and Dillon Financial Planning in Eagle.)

It is worth noting a mild debate in the Times column between two financial advisors I truly respect. Sheryl Garrett holds to the position that "very few people need a full time financial planner." What she is referring to here is the delegation of investment management to a financial advisor, and paying the advisor an annual retainer or a percentage of the assets being management. Although she admits this is appropriate for some, she feels "it's being way oversold, and the price is pretty steep."

Taking the other side of the argument is William Bernstein, author of some great investment books, including most recently, The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between. Bernstein points out that the most investors do a lousy job of managing their own investments, and thus lag the market by two or three percentage points. (See this Morningstar article on investor returns.) He thinks improved performance under a skilled advisor's full time management can more than offset the fees paid. "What you get from an advisor is not the winning allocation...What you are getting is the discipline. And an annual checkup provides precious little discipline."

Who is right? Well, I think both are right in their own way, and there is plenty of reasonable ground in between. There are many people capable of adhering to a disciplined investment strategy. Better yet, if they have the on-going coaching of a competent professional who can help develop the strategy and show them how to implement it in a cost effective manner. Garrett Planning Network advisors do this work every day, either by the hour or with a reasonable annual retainer fee.

I agree with Bernstein, however, that there is a significant element of the investing population who lack the discipline, desire, knowledge, or emotional make-up to effectively manage a sizeable investment portfolio. These people would be better off with delegating the management of the portfolio to a fee-only advisor who will keep them on track and allow them to benefit from market returns. If you fall in this camp, however, realize your need to be a vigilant, informed consumer, so you are not fleeced by elements of the financial services industry.

While on the subject of fleecing at the hands financial advisors, check out Jane Bryant Quinn's recent blog post. It's another reminder from the respected financial columnist that the commission-driven broker and insurance world is not your friend. Her advice: "The best way to protect yourself from commission-driven sales is to switch to a fee-only investment advisor. Fee-only advisors sell no products and take no commissions, they charge only for their advice. Two places to find them: The National Association of Personal Financial Advisors (napfa.org) and the GarrettPlanningNetwork.com."

The House Financial Services Committee passed the Investor Protection Act earlier this week, moving the legislation on to the full House of Representatives. The issue of whether all so-called "financial advisors" will have a fiduciary duty to their customers has been a hotly debated portion of this bill. Unfortunately, it is an issue that most investors are pretty much unaware of. For more on why you should care about this, read "Is Your Financial Advisor a Fiduciary?" and "The Critical Difference Between a Stockbroker and Registered Investment Advisor".

Although a major portion of the financial services industry (i.e. brokerage firms and insurance companies) has fought it, the proposed legislation extends the fiduciary standard to everyone who advises customers on the purchase of securities. So far, so good. However, seeing that battle lost, the brokerage world is embracing the idea of harmonizing the regulation of brokers and registered investment advisors (fiduciary advisors like Table Rock Financial Planning), and they now seek to weaken the fiduciary standard to something more of their liking. As Barbara Roper, director of the Consumer Federation of America said, "For years they've opposed the fiduciary duty. Now they've embraced it in order to gut it." If they are successful in watering down the standards, investors will lose--again.

Ask yourself, what standard of care do you expect from the person or firm advising you on your investments and other financial issues? Do the following five core principles of the authentic fiduciary standard describe the care you would like to receive from your advisor?

- Put the client's best interest first;

- Act with prudence; that is, with the skill, care, diligence and good judgment of a professional;

- Do not mislead clients; provide conspicuous, full and fair disclosure of all important facts;

- Avoid conflicts of interest; and

- Fully disclose and fairly manage, in the client's favor, unavoidable conflicts.

Why you wouldn't you expect this type of care? There is no compelling reason to expect anything less.

A recent Wall Street Journal article provides a good discussion of the issues. It talks about the changes that a true fiduciary standard would bring to the brokerage world:

The changes could transform the brokerage industry by changing the way products are sold and marketed and even how brokers are paid. Requiring brokers to operate under the existing fiduciary standard could force them to recommend more investments that are less costly and more tax-efficient. They would have to tell clients about any potential conflicts of interest, such as when they stand to gain personally by favoring one product over another. For example, a broker who recommends a mutual fund with a higher fee -- and one he gets a bigger commission for selling -- would have to disclose that potential conflict upfront.

These sound like good changes to me. However, these changes will make it more difficult for brokers to move dollars from the investors' pockets into their own. Maybe that's why they are so reluctant to embrace a true fiduciary standard.

In the first part of this post I covered the first four questions from the Wall Street Journal’s recent article “Seven Questions to Ask When Picking a Financial Advisor”. Today we’ll finish off the final three questions, again with my comments.

- What’s the advisor’s performance track record? If the advisor is actively managing investment portfolios (i.e. timing the market and/or picking individual stocks, bonds, or actively managed funds) this may have its place. However, even if you believe their performance numbers, haven’t we all learned that past performance is no guarantee of future results? A better discussion revolves around the advisor’s investment philosophy, and how he or she is going to help you attain your investment goals. With advisors who practice more passive investment strategies (like Table Rock Financial Planning), reviewing the track record is simply a review of the market performance of different asset classes—a worthwhile bit of education for all investors.

- Can the advisor put it in writing? Yes, you should expect this! A clear service agreement outlining what the advisor will do and what fees you will be paying is essential. Also (although it was not specifically mentioned in the article), if you are hiring someone to manage your investment portfolio, you should expect a documented “investment policy statement”. The IPS is the agreement with your investment manager on the how he or she is going to manage your portfolio. Although somewhat easy to miss this late in the article, the author makes her most important point,. “Finally, find out whether the advisors are going to take on fiduciary responsibility…to act in your best interest.” If not, they are only required to sell you products that are “suitable” for you, and “may not always be the best fit” for you. For more on this issue, see the recent post “Is Your Financial Advisor a Fiduciary?”

- What do the pros think? The parting advice is to “double-check any big moves.” This is a good idea, whether you employ other professionals, or do your own research. Depending on what the issue is, an hourly financial planner, like Table Rock, or other members of the Garrett Planning Network may be a good place to look for a second opinion.

n the previous post, I provided links to some more comprehensive questionnaires you could use when selecting a financial advisor. For a little different take on this exercise, look at the following articles from the Mole, Money Magazines undercover financial planner. First check out “Truth or Dare for Your Financial Advisor” and then “What Your Advisor Doesn’t Know Might Hurt You.” I believe the Mole is no longer publishing articles, but his work is archived and worth a look.

Finding a trustworthy, competent financial advisor can be a daunting task for consumers. Without a strong recommendation from someone you trust and who values the same attributes you do, where do you start? Knowing this question is top-of-mind with the recent highly publicized scandals The Wall Street Journal recently ran a significant piece entitled “Seven Questions to Ask When Picking a Financial Advisor”. Although the author made some good points, I have to admit I was somewhat underwhelmed by the advice.

In Part 1 of this post I’ll give you the first four questions listed in the article, and provide some of my comments:

- What’s the advisors background? State and federal regulators, along with industry organizations, go to great effort to provide regulatory and disciplinary records for those in the business of providing financial advice. The article provides useful links for your due diligence (click here for a list of those sites and more)—but, I have to admit, the process is less than user-friendly.

- What do the advisor’s clients say? Obviously, a strong recommendation from someone you know and trust would be nice. However, asking the advisor for references from past and current clients as the article suggests is somewhat problematic. Investment advisors are prohibited by law from providing client “testimonials”, plus they cannot disclose the identities of clients without their consent.

- How does the advisor get paid? The author correctly points out that “knowing how advisors are paid will help you tell if they’re working in your best interest.” Except for the admonition to “be wary of anyone who shies away from answering these questions in a transparent way”, the author didn’t provide much clear guidance. Although she outlined some of the different ways advisors are compensated, she gave only limited insight on why this matters. It would have been better to help confused consumers “connect-the-dots”, and show how a fee-only business model eliminates the potential conflict-of-interest created by sales commissions.

- Where are the advisors checks and balances? The Madoff scandal has certainly illustrated the importance of not giving investment managers custody of your funds. It is critical that a third party custodian (e.g. Schwab or Fidelity) holds your investments, that you make your deposits directly to and that you receive statements directly from that custodian. This is obviously less of an issue with planners who are providing financial advice, but not directly managing your investments.

In Part 2, I’ll cover the last three questions from the WSJ article. In the meantime, if you are interested in how to vet a potential financial advisor, here are a couple of other links that may interest you. First, the National Association of Personal Financial Advisors (NAPFA) provides a more comprehensive set of questions and diagnostics on their website. Also, the Garrett Planning Network provides a questionnaire and a free download of “Finding and Hiring the Right Advisor” from the Personal Finance Workbook for Dummies.

Is your financial advisor a fiduciary?

This is a very important question, but one many consumers don’t know to ask. Although there are many definitions or standards of fiduciary duty, it is essentially the obligation of an advisor to act in utmost good faith and in a manner he or she reasonably believes to be in the best interest of the client. In other words, the advisor has an obligation to put the client’s interests first.

Maybe a more pertinent question is, “Why would anyone settle for anything less from a financial advisor?”

This topic is heating up on a number of levels as the government considers changes to the way to the way it regulates the financial services industry. Jason Zweig, who writes the Intelligent Investor column for the Wall Street Journal, discussed some of the issues in “The Fight Over Who Will Guard Your Nest Egg” a couple of days ago, and it’s worth taking a look at. He explains that a registered investment advisor (RIA), such as Table Rock Financial Planning, is held to a fiduciary standard. However, stock brokers and others who may describe themselves as financial planners or advisors are not necessarily held to the same standard. For example, under Financial Industry Regulatory Authority (FINRA—the self regulatory body that oversees the brokerage industry) rules, brokers are generally required to recommend “suitable” investments to their clients. And, when determining what is “suitable”, cost is not an issue. Zwieg gives the following example to show the difference:

“Let's say you tell your broker that you want to simplify your stock portfolio into an index fund. He then tells you that his firm manages an S&P-500 Index fund that is 'suitable' for you. He is under no obligation to tell you that the annual expenses that his firm charges on the fund are 10 times higher than an essentially identical fund from Vanguard. An adviser acting under fiduciary duty would have to disclose the conflict of interest and tell you that cheaper alternatives are available.”

Matthew Hougan, writing on-line for IndexUniverse.com also discussed this issue in a recent post entitled “Yes on Fiduciary Duty”. He summarized the difference between the standard for the RIA and for the broker (or “registered representative”) and then stated:

“Think about that for a minute. A registered rep can put their own interests (or the interests of their firm) ahead of the interests of the client. That's absurd, and it explains why a lot of high-load, high-cost mutual funds have been pushed down the throats of the investing public over the years. There are a lot of good registered reps out there: smart people with great ethics who do good work for clients. But come on: This shouldn't be a tough question! Finance is a serious business. You're talking about people's lives, their retirement, their children's education.”

Should your financial planner be required to act in your best interests? I would hope so.

Next page: Disclosures