Categories: Retirement Planning

Date: May 29, 2012

Title: Social Security Spousal Benefits

One of the more thoughtful and "women friendly" characteristics of the Social Security system is the availability of various types of spousal benefits. These constitute some of the more complex features of the retirement benefit system, but also provide some fruitful planning opportunities.

When the Social Security Act was passed back in 1935, the initial provision of monthly benefits for retirees was set to begin in 1942. This allowed at least a small number of years for payroll taxes to build up a reserve. However, in 1939 the system was amended to pull in the start of monthly payments to 1940, and also added benefits for wives, widows, and dependent children of covered workers. In one fell swoop, Congress set the tone for the next several decades and established two important Social Security trends:

- It is easier to add additional Social Security benefits first, and let others worry about paying for them later. But, hey, before we complain about too much about Congress doing this, we should admit that this simply reflects the will and the behavior of the "average" American.

- The Social Security System is about enhancing the economic security of families, not just individuals. Since the common family model of that time was a working father and a stay-at-home mother, it was important to also ensure the economic well-being of the non-working spouse and children. Interestingly, spousal benefits were initially provided only for women, not for men. (This was changed after Ozzie Nelson organized a massive march on Washington by stay-at-home dads in the mid 1950s.) As a result of spousal and dependent benefits, married workers and their families generally stand to receive more out of the Social Security System than single workers.

Here are the key rules regarding Social Security spousal benefits:

- The spousal benefit is calculated off the retired workers primary insurance amount (PIA), which is the worker's earned retirement benefit at full retirement age (FRA). Full retirement age is 66 for workers born between 1943 and 1954, but transitions to age 67 for younger workers.

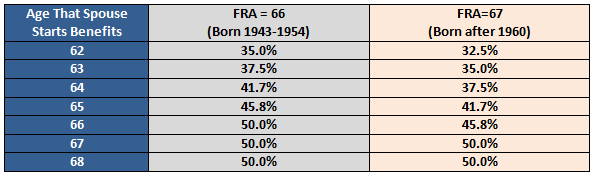

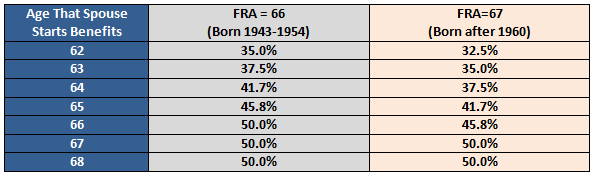

- A spouse is eligible for up to 50% of the retired worker's PIA, but the exact amount depends on when the spouse (not the retired worker) files for monthly benefits. At the spouse's full retirement age, the benefit is 50% of their husband or wife's PIA. However, if benefits are taken earlier than FRA they are reduced by 25/36 of one percent for each of the first 36 months. After 36 months, the reduction is only 15/36 of one percent per month. The table below shows the percentage of the worker's PIA spouses can expect, depending on when they start benefits, and whether their own FRA is at age 66 or age 67.

- Waiting beyond FRA does not increase the spousal benefit. This is in contrast to a worker's own benefit that can grow considerably from FRA to age 70 with delayed retirement credits. Even if the worker delays until age 70, maximizing his or her personal benefit with delayed credits, the spousal benefit will not increase--it is always calculated off the worker's PIA. Conversely, the spousal benefit is not reduced if the worker chooses to claim a reduced benefit as early as age 62.

- Age 62 is the earliest a person can apply for spousal benefits, unless they are caring for a "qualifying child"--i.e. a dependent child under the age of 16, or one receiving Social Security disability benefits. Unlike normal spousal benefits, if the spouse is caring for a qualifying child the benefit is not reduced for early receipt.

- Generally, a spouse must be married to the worker for at least one continuous year prior to applying for benefits. This requirement is waived if the spouse is already receiving survivor benefits or spousal benefits off an ex-spouse's work record.

- The spouse cannot claim benefits until the worker is "entitled" to benefits. In other words, the worker with the earned benefit must either be receiving benefits, or have filed for, but suspended receipt of his or her benefit. (More on why someone would the "claim and suspend" later.)

- If the spouse is working and has not yet hit their FRA, any spousal benefits they receive may be reduced if they exceed Social Security earnings limitations ($14,640 for 2012.)

In the next post we will look at some of the implications of the spousal benefits, along with how cultural trends will impact the amount of "replacement income" that Social Security will likely provide future individuals and families. And, if you are wondering about how retirement benefits work for divorced spouses and widows (and widowers), these will also be examined in coming weeks. Finally, we will look at some of the planning opportunities provided by the very thoughtful, but very complex Social Security retirement system.