Financial Planning Blog

Think Twice Before Taking Social Security Benefits Early (Part 2)

Think Twice Before Taking Social Security Benefits Early (Part 2)

The decision of when to start receiving Social Security benefits is one of the most critical retirement choices many of us will make. You would think this would be a fairly simple problem, but it is much more complex than people realize. Unfortunately, it appears many are making this decision with inadequate information--or are simply making poor long term financial choices. Before you jump to the conclusion that taking your Social Security retirement early at age 62 is a good idea, consider these reasons why it may in your (and your spouse's) best interest to wait until your full retirement age, or even age 70.

Guaranteed growth of your monthly benefit: In Part 1 an example is shown of how a retiree's benefit is affected by choosing to take retirement benefits early, or by delaying until age 70. In effect, your benefit is growing at a compounded real (i.e. after inflation) rate of over 7%/year. And this rate of return is essentially riskless, with the U.S. government standing behind it. The likelihood of you doing better than this investing on your own is pretty low, and you would assuredly be taking on much more risk.

Enhanced protection from longevity risk: One of the great things about Social Security is that it provides a benefit that will last as long as you are alive. Even if you run your savings down to zero, you will never totally run out of money--you'll still have your Social Security retirement benefit. It just may not be as large as you would like or need. In the Part 1 example, the person who waited until age 70 had a monthly benefit that was 76% higher than one who took it at 62 ($1,320 versus $750), with cost-of-living adjustments locked in for life. This higher benefit is a great way to help deal with longevity risk (i.e. an individual's risk of outliving their financial resources), and could make a substantial difference in the person's quality of life in the later years.

Sure, if the retiree dies prior to their age expectancy, taking the benefit early at 62 would have resulted in a larger lifetime total from Social Security, than if they had waited until 70 and taken a higher benefit for fewer years. However, dealing with longevity risk is not about maximizing benefits in the short term, but avoiding old age poverty in the long term. Think about it--if you die prior to normal life expectancy, the thought of not getting every potential dollar from Social Security is probably not a major concern. However, worries about running out of savings and being a burden on others late in your nineties is something that could keep you up at night.

Protecting the surviving spouse: For married couples the case for waiting to take Social Security is generally even more compelling. If you are married, understanding and coordinating your Social Security retirement benefits is a key part to making sure each spouse is financially secure, before and after one of you dies. To understand how the decision of when to start Social Security retirement benefits impacts the financial security of the surviving spouse, you need to understand how Social Security survivor benefits are figured.

- Upon the death of one spouse, the surviving spouse is generally entitled to the greater of their two benefits, but is not able to continue receiving both. Thus, the surviving spouse can continue to receive their own benefit, if it is larger, or receive a benefit based on the deceased spouse's work record.

- Assuming a person dies after starting benefits, then the surviving spouse is entitled to the larger of the deceased spouse's benefit, or 82.5% of the deceased spouses PIA (primary insurance amount). In other words, if the deceased spouse waited until FRA (full retirement age) or later, the surviving spouse will continue to receive the higher benefit earned from delaying the start of benefits.

- Using the example in Part 1, and assuming the deceased had started receiving benefits and the surviving spouse is past FRA, the survivor's benefit would be the following:

- If the deceased spouse started benefits at age 66 (FRA), then the surviving spouse would continue to receive $1000/month.

- If the deceased spouse had waited to start benefits at age 70, then the surviving spouse would continue to receive $1320/month.

- If the deceased spouse had started benefits at age 62, then the surviving spouse would be entitled to only $825/month. (The deceased spouse's benefit was only $750/month, but the spouse receives at least 82.5% of the deceased spouse's PIA, which was $1000.)

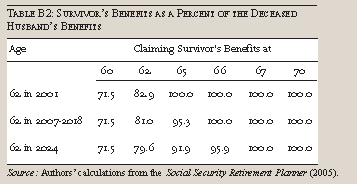

- If a person dies prior to collecting benefits, then the surviving spouse is entitled to 100% of the deceased spouse's earned benefit (PIA plus any delayed retirement credits), assuming the surviving spouse waits until FRA to collect. If the surviving spouse chooses to collect benefits earlier (as early as age 60), they are reduced as shown in the table below.

Source: Why Do Women Claim Social Security Benefits So Early? --Center for Retirement Research at Boston College

This does get complicated, but the bottom line is this--in general, having the higher earning spouse wait until age 70 to collect Social Security retirement benefits is a wise choice. There are always exceptions, but this strategy should be considered. This is because the higher, cost-of-living adjusted benefit is secured across both spouse's lifetimes. There is a high likelihood this strategy will pay off not only in higher lifetime benefits across both lives, but in greater financial security and peace of mind.

Waiting until age 70, or even age 66 or 67, to draw Social Security seems like forever to many, however it may be the most prudent strategy. Unfortunately, the majority of married men start claiming benefits early, at age 62 or 63, to the detriment of their wives who are likely to survive them. Women have longer life expectancies, and more often than not, are younger than their husbands. They are also more likely to have lower earned benefits, making the higher survivor benefit extremely important to them. According to the analysis by Sass, Sun, and Webb at the Center for Retirement Research at Boston College:

That many married men "leave money on the table" is surprising. It is also problematic. It results in much lower benefits for surviving spouses and the low incomes of elderly widows are a major social problem. If married men delayed claiming Social Security benefits, retirement income security would significantly improve...

Something akin to social convention or mistaken information needs to motivate the general tendency to claim early. Households aware that social convention and "conventional wisdom" lead to sub-optimal outcomes are the ones most likely to pursue a different path.

Before you start taking receiving your Social Security benefits make sure you understand the long term ramifications for both yourself and your spouse. Talk to a financial planner who can help you understand your choices and how they interact with the rest of your retirement financial plan.

In Part 3, we'll look at some situations or strategies where claiming Social Security benefits early may make sense.

Next page: Disclosures