Financial Planning Blog

Safe, Sustainable Withdrawal Rates and the 4% Rule (Part 1)

Safe, Sustainable Withdrawal Rates and the 4% Rule (Part 1)

People always want to know how much money they need to retire. Alternatively, those that have already pulled the trigger on retirement want to know how much money they can safely spend from their investment portfolio each year. The honest, but unsatisfying answer is (wouldn't you know it)--it depends. It depends on many things, many of which can't be known with much certainty. For instance:

- How long are you going to live?

- How is your portfolio going to be invested over the rest of your life?

- What will your investment returns be, year-by-year, over the rest of your life?

- What will taxes be on your portfolio over the rest of your life?

- Do you wish to leave an inheritance, and if so, how much?

- How sensitive are you to the potential of running out of money in your old age?

You get the picture. Even though we crave a simple answer, life is complicated. And, even though we try our best to create reasonable plans for the future, we are reminded instead just how much is out of our control. In an attempt to create some order out of this chaos, financial planners and economists continue to research and write extensively on the subject of safe (or sustainable) withdrawal rates*.

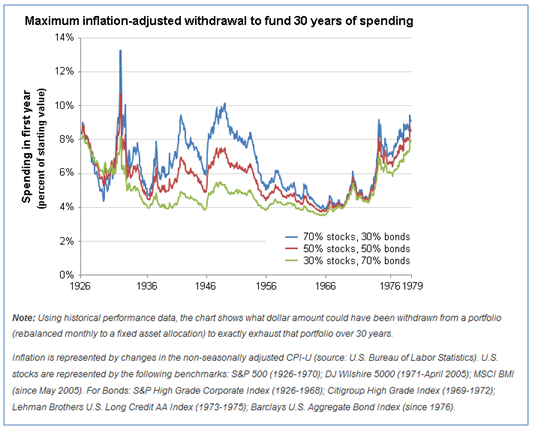

A safe withdrawal rate is the maximum amount of money, expressed as a percentage of the initial portfolio, which can be withdrawn each year with a very high likelihood that the portfolio would not be completely exhausted within a specified timeframe. The safe withdrawal amount is generally incremented each year to account for inflation in order to maintain a constant purchasing power. The timeframe used is usually one that the individual (or couple) is unlikely to significantly outlive.

The 4% Rule

To illustrate the concept of a safe withdrawal rate let's look what has become known as the 4% rule. First of all it is important to note that the 4% rule is not an absolute like "don't run with scissors" or "time being equal to money". It is more of a rule of thumb, or good practice. You encounter these rules of thumb in many disciplines. Of course, the most famous is "Never get involved in a land war in Asia," but only slightly less well known is this: "Never go in against a Sicilian when death is on the line!"

The 4% rule (of thumb) is illustrated as follows:

- An investor retires at age 65 with a $1M portfolio.

- This portfolio is invested with a reasonable amount in stocks (e.g. 40-60%) and the remainder in safer bond investments.

- The investor can withdraw $40K (4% of the $1M) in year 1.

- The next year the retiree can withdraw another $40K, plus an inflation adjustment. If inflation was 3%, the withdrawal is adjusted to $41.2K.

- The next year the retiree can withdraw the $41.2K, plus an additional inflation adjustment. If inflation was 5%, the withdrawal becomes $43.26K

- If the future is reasonably similar to the past, the portfolio will be able to sustain these inflation adjusted withdrawals for at least 30 years (until age 95) with a high degree of probability.

The chart below illustrates the maximum sustainable 30 year withdrawal rates portfolios have supported from 1926 through 1979. (A retiree starting in 1979 would have completed his 30 years of withdrawals in 2009, about when this chart was created.) You will note how retirees starting in the 1960's and early 1970's could only sustain about 4% withdrawals. However, if they had the good fortune to start in the post war years or late 1970's, their portfolios could sustain withdrawals above 6% a year.

Source: Vanguard, "Does the 4% Rule Hold Up", August 2010

Why the difference in sustainable withdrawal rates, depending on the start date? The short answer is folks that face bad markets early in retirement as they start making large withdrawals will only be able to sustain lower withdrawal rates. Those lucky enough to have strong markets early in retirement will likely be able to sustain higher rates of withdrawal. Even if two retirees have identical average portfolio returns over their 30 year retirements, the one who has good years early will do better than the one who faces an early bear market. This is often referred to as sequence risk.

In a world where more of us will be relying on withdrawals from our IRAs and 401K plans, as opposed to guaranteed defined benefit pension plans, we need to understand how to manage our portfolios for long term sustainability. Accordingly, the concept of safe, sustainable withdrawal rates is an important one for retirees and pre-retirees to grasp. Rest assured the 4% rule is not the last word on managing your portfolio in retirement. In follow-on posts, we will discuss why the 4% rule is probably too conservative...or possibly not conservative enough.

-----------------------------------------------------------------------------* Some of the early, influential work in the arena of safe withdrawal rates, including the origins of the 4% rule are listed below:

Bengen, William. Determining Withdrawal Rates Using Historical Data. Journal of Financial Planning--October, 1994.

Cooley, Philip, Carl Hubbard, and Daniel Walz. Retirement Savings: Choosing a Withdrawal Rate That is Sustainable. AAII Journal--February, 1998.

Ameriks, John, Robert Veres, and Mark Warshawsky. Making Retirement Income Last a Lifetime. Journal of Financial Planning--December, 2001

Next page: Disclosures