Categories: Retirement Planning

Date: Oct 12, 2011

Title: Safe Withdrawal Rates—Maybe the 4% Rule Should be the 3% Rule (Part 3)

In the last post we explored a number of reasons why the 4% rule may be too conservative. Although it would be nice to leave you on such a positive note, it is worthwhile to balance this with a more cautious perspective.

Why a 4% safe withdrawal rate may be too optimistic

Most safe or sustainable withdrawal rate studies are based on historical data, and the general assumption is that future returns will be similar to the past. Two issues with this approach are identified by a number of researchers.

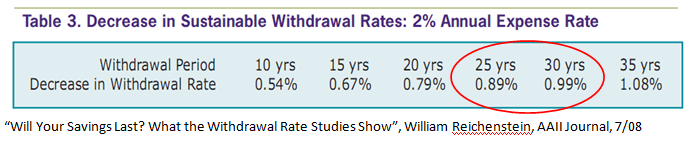

First, many (but, not all) safe withdrawal rate studies ignore the impact of that investment costs have on investor returns. On average, investors will not earn the gross return to stock market index, but rather a net return after costs. Between mutual transaction costs, mutual fund expenses, and potentially investment management fees, it is easy to imagine a drag of at least 1% to 2%. William Reichenstein of Baylor University calculates that if you assume investment returns are 2% lower than the historical gross (i.e. before investment costs) returns, then sustainable withdrawal rates over 25 to 30 year periods are about 1% lower. In other words, your 4% to 4.5% safe withdrawal rate becomes 3% to 3.5%.

Second, there is no guarantee that future market returns will be as generous as the past hundred or so years of data. In fact, many influential investment managers and economists expect lower market returns over the next ten to twenty years. They point to historically low dividend yields, high stock market valuations (i.e. price to earnings ratios, or the amount investors are paying for a dollar of corporate earnings), low interest rates, and concerns over future economic growth as harbingers of lower future stock and bond market returns. Here is a sample of prominent voices on this subject:

This just brings home the fact that future market returns are not some sort of entitlement. We don't know what the next 10 to 20 years has in store in regards to market returns, but it is probably unwise to presume that the future will deliver historically healthy results. Although the concept of a safe withdrawal rates is a tool to deal with these risks and uncertainties, there may be reason to be a bit more cautious. (For one such cautious approach, see this video where Ken French of Dartmouth discusses establishing a safe withdrawal rate starting with Treasury Inflation Protected Securities, or TIPs.)

As discussed in Part 2, it is unrealistic for someone to set a withdrawal rate and leave it untouched for 30 years. For a successful outcome (i.e. one that doesn't involve moving in with your children or becoming a regular at the food bank), it is important to be attentive and flexible. If the markets are not delivering adequate returns over the first critical 10 to 15 years of retirement, you will certainly be getting real time feedback on your account statements. If that doesn't alert you to cut back a bit on spending, take the hint when your financial advisor suggests you look into jobs at Walmart.

----------------------------------------------------------------------

*Bogle breaks the the sources of stock market return into: