Financial Planning Blog

Managing Your Risks (Part 2)

Managing Your Risks (Part 2)

In Part 1, the first three risk management topics mentioned in the Morningstar article, "Are You Adequately Insured Against Risk?" are discussed. The remaining three risk topics are covered here.

Disability income insurance--You face a much higher risk of being unable to work because of a disability, at least temporarily, then from premature death. Unfortunately, many Americans do not have adequate insurance to replace a lost income in case of a disability. Many believe that Social Security will cover them in the event of a disability, but this may prove to be an erroneous assumption since Social Security benefits will not necessarily be sufficient and are very difficult to qualify for (believe it or not).

Disability insurance is complicated, and although necessary, it can be expensive. This is an area that a competent insurance professional can really help out. For some good background on disability insurance policies, here (and here) are a couple of Investopedia articles for some background on the subject.

If you are fortunate enough to have disability income insurance from your employer, consider two things. First, if your employer is paying your premium, your benefits will be taxed. If you pay for the coverage yourself with after-tax dollars, your benefits will be tax free. Second, after you figure your after-tax benefits, is this coverage truly adequate to protect your family? You may want to purchase additional DI insurance above your employer provided coverage.

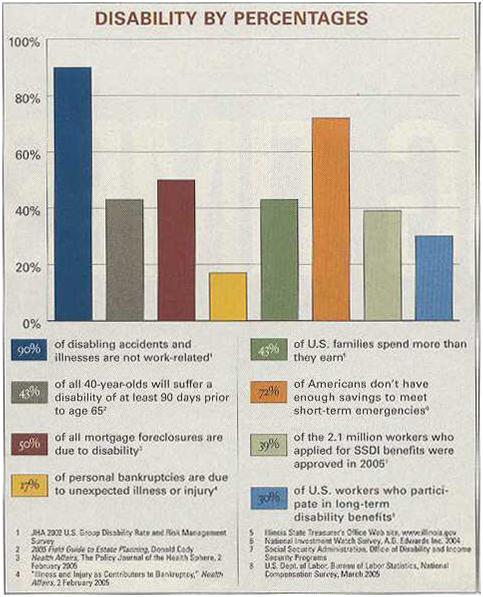

For some interesting disability statistics, check out this chart from the Zander Insurance website.

Umbrella liability policy--These personal liability policies are secondary insurance that sits on top of your auto and homeowner's policies, providing higher levels of liability protection in case you are sued. If you have significant assets to protect you should look into adding an umbrella policy. Although it bothers me to buy too much insurance, in this litigious society the additional peace of mind may be worth the relatively small additional cost. You should consider the potential risks your family faces--whether it is your swimming pool, teenagers who are driving, big dogs, rental property--and think through whether you need this additional insurance. Surprisingly, I find that insurance salesmen don't always push this extra coverage. For more on this topic check out these articles from MSN Money, the NY Times, and Investopedia.

Long term care insurance--The risk of needing expensive long term care late in life is substantial. Like it or not, studies show that for those who live to age 65, you have a 40-50% chance of receiving care in a nursing home. And, this care is expensive--the average cost of a private room in Boise was over $70K per year in 2007. Of course, long term care encompasses more than just nursing homes, but also home care, assisted living, and potentially other care. Whether you self insure, or purchase long term care insurance, the potential for long term care expense is a risk we need to plan for, not ignore. These are tough decisions, and need to be considered in your retirement planning. Again, this is an area that a competent financial planner can add significant value.

A good place to start for long term care information is the National Clearinghouse for Long Term Care Information.

Next page: Disclosures