Financial Planning Blog

Longevity Risk--Securing Income for a Lifetime (Part 1)

Longevity Risk--Securing Income for a Lifetime (Part 1)

Those of us preparing for future retirement face an assortment of risks. There is the concern of an extended bear market just as you start taking distributions from your retirement portfolio. There are risks related to rising health care costs and the potential need for long term care. Some worry about the stability of the Social Security system, or the financial integrity of their employer's pension plan. (That is if you are lucky enough to have a pension...or an employer.). On top of these risks, we should also be somewhat concerned that high government spending may lead to rampant inflation, degrading the purchasing power of our retirement incomes.

Now, add to these concerns the additional risk of living too long (i.e. longevity risk).

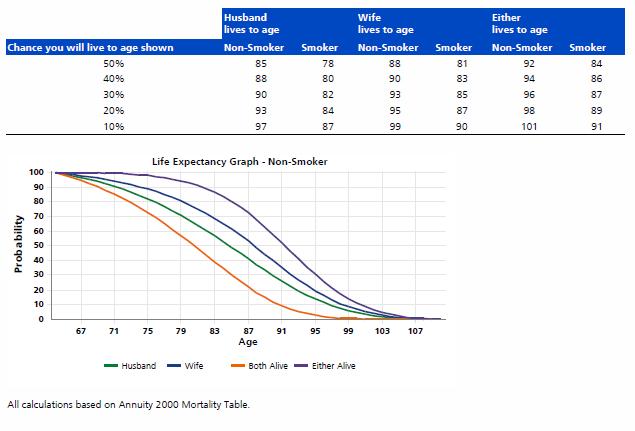

The fact is many of us may live longer than we plan. The chart below shows the statistics regarding life expectancy for American 65 year olds. A 65 year old non-smoking male has a 50% chance of living an additional 20 years average-or an average life expectancy of age 85. You can't just plan for 20 years of spending, however, because there is a 30% probability of living to age 90, and a 10% probability of living until 97.

For 65 year old non-smoking females, there is a 50% chance of living an additional 23 years--or an average life expectancy of age 88. Again, you have to take note of the 30% probability of living to age 93, and 10% probability of living to age 99. A married couple (non-smoking, both age 65) planning for their future income requirements must realize there is a 50% chance that at least one will live to age 92, and a 30% chance that one will live to 96.

Take heed--if you fail to plan for a long life, your future could be one of great financial insecurity. Making sure your financial resources provide sufficient income for 30+ years is a tricky proposition that takes planning and discipline. We must make trade-offs between current consumption (i.e. lifestyle), the amount of money we hope to leave our heirs or charity, and the amount of risk we are willing to bear (i.e. the chance of falling short). Failure could mean relying on assistance from our grown children, a reduced standard of living (hopefully not involving dog food), or ending life in a substandard nursing home paid for by Medicaid. Most of us don't plan to fail--but, we do fail to plan.

One useful financial tool in managing longevity risks is the fixed immediate annuity (or fixed life annuity, or lifetime annuity). With an immediate annuity, a person (the annuitant) gives an insurance company a lump sum of money (say $100,000) for the promise of a monthly income (say $600-$700) for the rest of their life. By securing an income stream for their entire lifetime, the annuitant effectively trades the risk that they will outlive their money to the insurance company. In return, the annuitant takes on the risk that they will die early and will not recoup their investment.

Many financial academics have long been in favor of fixed immediate annuities, and they lament their lack of acceptance among consumers. I have to admit I was never in favor of the idea annuitizing any of my retirement nest egg until I began to research the subject over the last few years. I have always been skeptical of any product called an "annuity", fearing complexity and high fees. In buying an annuity I figured I would be doing more to secure the salesman's retirement than my own.

Harold Evensky, a highly respected financial planner and President of Evensky and Katz Wealth Management in Florida, also changed his mind regarding immediate annuities. "A number of years ago I told someone that, if I ever recommended fixed annuities, they should wash my mouth out with soap. The story is different today. Immediate annuities are the single most important planning vehicle for the next decade...Today there are low cost providers that offer very competitive products."

In Part 2, well take a closer look at how immediate annuities may fit in your retirement plan. In the meantime, if you want to learn more about immediate annuities there was a good article recently in the NY Times. Also, this Walter Updegrave (CNN Money) column and this Investopedia piece will give you plenty of background.

Next page: Disclosures