Financial Planning Blog

Long Term Care Insurance—A Difficult Decision (Part 1)

Long Term Care Insurance—A Difficult Decision (Part 1)

One of the most important decisions a person (or couple) needs to make in regards to retirement planning is whether to buy long term care insurance (LTCI). It is a difficult decision to analyze and a subject most would prefer to ignore. In spite of the difficulty or unpleasantness, the risks of substantial long term care costs are real and need to be thoughtfully considered. The LTCI decision not only impacts the quality of care you may receive in the future, but likely has significant financial implications for others in your family.

In Part 1, we will define what long term care (LTC) is and examine the risks associated with potentially requiring it. Part 2 will be a quick summary of things you need to know about long term care insurance. Part 3 will be a discussion of the long term care financing decision.

What is long term care?

Unlike traditional medical care, where the goal is the cure or correction of a condition, long term care is focused on helping individuals live with chronic conditions--physical ailments, disabilities, or cognitive impairment. Long term care provides assistance to meet basic living needs for an extended period of time. These supportive services are often defined as either skilled care or personal care.

- Skilled care is provided by medical personnel (e.g. registered nurses) and must be ordered by a physician and follow a plan. Skilled care is often provided in a nursing home, where it is available 24 hours a day, but can also be received as in-home care.

- Personal care, or custodial care, is focused on helping with activities of daily living (i.e. bathing, eating, dressing, toileting, continence, and transferring). It is delivered in a variety of settings by less skilled providers.

What is the risk?

Long term care is an important risk to be concerned with because of the relatively high probability of an individual eventually needing care, and the potentially high cost of that care. Studies(1,2) show that if you are an American male at age 65, you have about a 33% chance of receiving care in a nursing home. The probability of requiring nursing home care is >50% for American women. For those who do enter a nursing home, there is a >50% chance of staying for longer than 1 year, and a 15-25% chance of staying for 2 years or longer. The average age for entering a nursing home is about 84 years.

Long term care is delivered in more than just nursing homes, so these statistics understate the risk. When you consider the other LTC options (e.g. assisted living, group home care, home care, adult day care, respite care, etc.) your chances of needing some type of care is at about 70%(2). This is, of course, somewhat dependent upon your family support system.

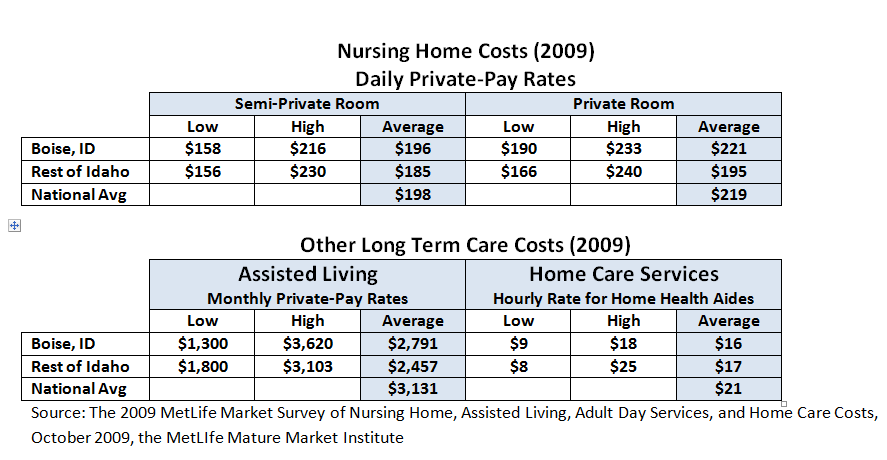

The cost of long term care can vary widely across different localities, and across facilities within a locality. MetLife does an annual survey of long term care costs across the country, and below are the costs they observed in Boise and the rest of Idaho. You'll note that nursing home costs in Boise track the national average, but assisted living and home care are somewhat lower.

In case you didn't do the math, the average cost of nursing home care in Boise for one year is over $70K for a semi private room, and over $80K for a private room. Assisted living averages over $33K per year. These are pretty scary numbers, especially if you aren't financially prepared. When you consider the possibility of these costs rising faster than the overall inflation rate the numbers are daunting. In 25 years, that $70K per year for a semi private room in a nursing home becomes over $145K with 3% inflation, and over $235K at 5% inflation.

These numbers should get your attention. And, in case you were counting on Medicare to cover these costs, think again. Medicare covers only pays for part of the first 100 days in a nursing home, although it offers more open-ended coverage of home care for those with skilled care needs. Your private health care insurance coverage for LTC will also be limited-you need LTCI for private extended care coverage. Without LTCI, you will need to cover the cost from your own income or assets. If you cannot pay for your care, you will need to rely on your family or Medicaid to cover the costs. Unfortunately, from a taxpayer's perspective, Medicaid has become the default LTC insurance provider for the lower and middle classes--it accounts for close to 50% of total LTC expenditures. (More on this later.)

In Part 2 we will examine some of the key features of long term care insurance. In the meantime, you might want to go the National Association of Insurance Commissioners and request a free Shopper's Guide to Long Term Care Insurance.

---------------------------------------------------------------

1) Stillman and Lubitz, "Medical Care" (2002)

2) Stone, "Long-Term Care for the Elderly with Disabilities: Current Policy, Emerging Trends, and Implications for the Twenty-First Century" (Milbank Memorial Fund--2000)

Next page: Disclosures