Financial Planning Blog

Help with Student Loan Debt

Help with Student Loan Debt

Do you know someone who is struggling under the burden of student loan debt? With about two-thirds of graduates leaving college with an average of over $23,000 in student loans, there are many individuals and families dealing with the long term implications of education indebtedness. Although student loans, when used conservatively, can be a significant aid in helping some students finance their education, they have become curse to many. The poor economy and high unemployment of recent years has made a difficult situation worse.

There are many federal programs in place to assist people with repayment of their student loans, and struggling borrowers should familiarize themselves with their features to determine if they are a good fit for their situation. Meanwhile, the rest of us can sit back and debate whether these programs are a wise public investment, or simply another public bailout out of an additional group of irresponsible borrowers.

Income Based Repayment (IBR)

In an effort to keep loan payments affordable to borrowers, a new repayment option is available to many. The Income Based Repayment option does two big things for those with federal student loans (not private loans or parent PLUS loans) who apply:

- It keeps loan payments down to an affordable level. Federal student loans payments will be capped according to a scale based on income, family size, and state of residence. Currently the loan repayments are set at just 15% of the amount a borrower's adjusted gross income (AGI) exceeds 150% of the poverty level. This can result in significantly lower monthly payments, and in the case of very low income or large families, even zero payments. For most borrowers, the monthly payments will be under 10% of their income. Whatever the payment, it will be less than the standard 10 year loan amortization payment, or else you won't qualify for the program. And, if the newly calculated payment is not high enough to cover the interest on the loan, your Uncle Sam will even pay the interest on Subsidized Stafford Loans for up to three years. For other loans, and after three years on the Stafford ones, the interest will accrue and be added to the loan balance. Of course, this may not matter because of #2.

- The remaining loan balance is forgiven after 25 years of qualifying payments. This is a long time to make payments, but at least there is a final resolution. In the meantime, payments have been kept at a manageable level. Be aware, the amount of loan forgiveness is taxable in this program, although there is talk about changing this.

The Student Aid and Fiscal Responsibility Act (you have to love the name) that was included in the recent health care reform bill (any obvious connection?), makes this deal a bit sweeter after 2014. It drops the 15% income cap to 10%, and the 25 years to 20 years for forgiveness.

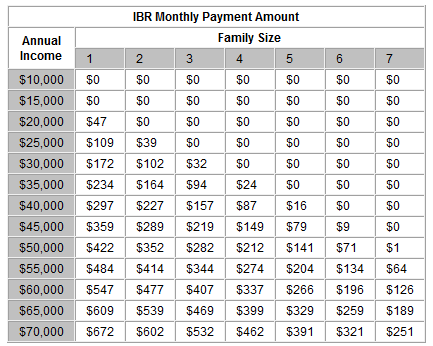

Below is a chart from the Federal Student Aid website that shows the maximum monthly payment for various income and family sizes. Let's take a look at potential benefit from the program to the average new graduate with $23,000 of federal student debt, say at 5% interest. Paying off that debt over the standard 10 years would require payments of about $245/month. If this graduate was part of a family three, earning $40,000/year, the payment would be limited to less than $160/month-a reduction of at least $85/month. Of course, our graduate will still be paying on the loan for long after 10 years, if she doesn't eventually ramp up her payments.

From: www.studentaid.ed.gov

Public Service Loan Forgiveness (PSLF)

With the IBR program, the borrower must wait for 25 years before the loan is finally cancelled. However, for graduates who work in a wide range of "public service" jobs, forgiveness is accelerated to just 10 years. Public service employment includes federal, state, and local government jobs, along with non-profit, tax exempt 501(c)(3) organizations. Employment must be considered full time, and documentation of employment will be required. Keep good records!

Like the IBR, the Public Service Loan Forgiveness program is only available for certain federal loans--Stafford, Grad PLUS, or consolidation loans in the Direct Loan program. Only payments made after October 1, 2007 count toward the 10 years (or 120 monthly payments). The borrower does not need to be participating in the IBR plan--although it definitely may make sense if they are eligible.

Other Federal Loan Forgiveness Programs

Besides the PSLF, there are many other federal loan forgiveness programs available to certain occupations. One popular program is for full-time teachers in elementary or secondary schools designated as serving a high percentage of low income families. (For the surprising long list of eligible Idaho schools, click here.) Up to $5,000 of Stafford loans are forgiven for teachers who have served for 5 consecutive years in a qualifying school. For secondary math and science teachers, or special education teachers, the amount of loan forgiveness is $17,500 after 5 years. Up to 100% of Perkins loans can be forgiven in a similar program.

A surprising number of other forgiveness programs are available, including those offered by the National Guard, the Peace Corps, AmeriCorps and VISTA. Go here for links to information on these and programs geared toward medical and legal professionals.

Next page: Disclosures