Financial Planning Blog

Social Security Retirement Benefits—Taking Them Early or Delaying

Social Security Retirement Benefits—Taking Them Early or Delaying

In planning for retirement there are many critical decisions that affect a person's, or couple's, long term financial security. One, of course, is the decision of when to stop working, earning and saving, and move to a new phase of managing and spending down your accumulated retirement assets. A second key set of decisions is when to start taking benefits from a pension plan or Social Security. Unfortunately, many Americans are no longer covered by defined benefit pension plans, so there is no decision to make here. But virtually all Americans can expect to receive Social Security retirement benefits, and have important choices to make on the timing of those benefits. It turns out that this decision isn't as straight forward as one might expect. However, judging by the behavior of many people, it is a decision that is apparently made without adequate information or analysis, or simply taken too lightly.

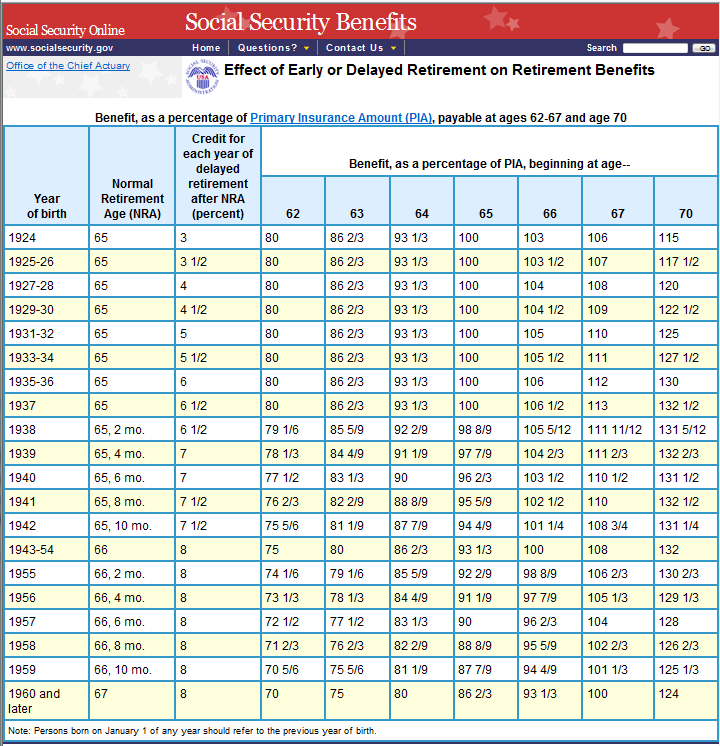

First, a quick explanation of the basic choices of when to start receiving your Social Security retirement benefits is in order. Each person has a designated Full Retirement Age (FRA) that differs depending on when they were born, currently ranging from age 65 to age 67. (The FRA is sometimes referred to as the Normal Retirement Age, or NRA, as it is in the chart below.) If a person starts taking benefits at their FRA they will receive the full benefit that they have earned, often referred to as their Primary Insurance Amount (PIA). However, any person can choose to start taking retirement benefits as early as age 62, but these monthly benefits will be reduced for life. Alternatively, a person can choose to wait until as late as age 70, with their monthly benefits growing larger all the while. The table below shows how this works.

Source: Social Security Administration (www.SSA.gov)

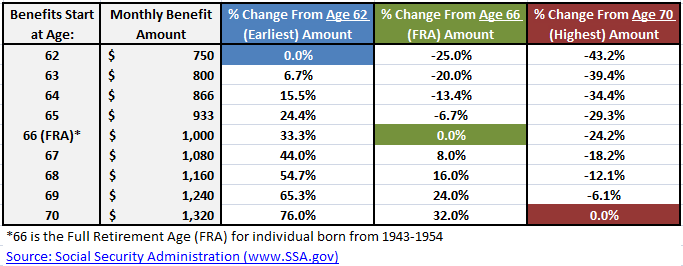

The key take away from this chart is that the decision of when to take one's Social Security benefit has a huge impact on the size of the benefit. To make this point a bit more clear let's look at an example of a person who has a Full Retirement Age of 66, and has earned a monthly benefit of $1000 (the PIA).

As you can see, if this individual decides to take their benefit at age 62, it is reduced to only $750 per month. However, if they wait until FRA (age 66), their benefit is 33% higher, at $1000/month. And, if they can wait until age 70, the benefit is a whopping 76% higher, at $1320. (These figures ignore the impact of cost of living increases, which are calculated on both early/reduced benefits and the higher delayed benefits.)

Why would anyone take their benefits early, when they grow at such a high rate if you wait until FRA or, better yet, age 70? The benefit increase in this example, from $750 to $1320, is equal to a real (after inflation) compound annual growth rate of over 7.3% per year-and it is guaranteed by the US government. You can't find that type of guaranteed real return anywhere else. You may even be lucky to get that type of real return from the stock market, even though you would be taking substantially more risk.

There are a few obvious reasons why a person would choose to take their benefits early. First, they may be unable to work any longer and have no other income source. They simply need the money and cannot wait. Or, a person may just be impatient, preferring the money today, with little thought for tomorrow. (It may be hard to imagine, but at age 62 some people still behave like teenagers, at least in their finances.)

However, for many individuals that choose to take benefits early (as the majority of people do*), they believe that they will not collect benefits long enough for any higher delayed benefits to offset the loss of several years of reduced benefits. Social Security claiming age benefit reduction and increases are designed to be actuarially fair--meaning that if a person lives to life expectancy, the expected present value of benefits received from the government would be essentially equal whether a person chooses to take benefits early or later. Apparently, many people are betting that:

- They will die before life expectancy, thus they will maximize the amount of Social Security benefits by claiming earlier than later. At age 65, life expectancy is about 82 for males and 85 for women. Dying before these ages may be a reasonable assumption from those in poor health, or who come from families with a history of shorter life spans.

- Or, the Social Security system will not be able to pay full benefits in the future. In effect, they choose to get whatever money they can as early as possible before benefits are reduced or eliminated due lack of adequate funding. Although the Social Security system is probably on sounder footing than these people realize, and it appears that Congress will address long term funding issues sooner than later, there are certainly a number of people who espouse this negative view and use it as a rationale to take benefits early.

The ability to take Social Security benefits early, or wait and allow them to grow at a healthy rate, makes this system extremely flexible for Americans entering retirement. However, the optimal decision of when to start taking Social Security is complex, especially when you consider the benefit interactions for married couples, including spousal and survivor benefits. Many scholars believe Americans are often starting their retirement benefits too early--and that this decision has a negative impact on the long term financial security of individuals and couples. In Part 2, we will examine the rationale for delaying the start of Social Security benefits.

---------------------------------------------

*Although the percentage of individuals claiming Social Security retirement benefits has been declining since the late 90's, still 43% of the men, and 48% of the women who turned 62 in 2006 chose to start taking benefits. This compares to 62% of the women, and 51% of the men who chose to start benefits as soon as they were available in 1985. (Muldoon and Kopcke, Center for Retirement Research at Boston College, 2008.)

Next page: Disclosures