Financial Planning Blog

Reasons to Love the Roth IRA

Reasons to Love the Roth IRA

Would you rather have $250K in a traditional IRA or $190K in a Roth IRA?

A trick question? Maybe, but if you know much about IRAs, you know the answer isn't obvious. One thing for sure, however, is that a dollar in a Roth IRA is worth more than a dollar in a traditional IRA (or 401k, 403b, or taxable investment account).

There is much to love about the Roth IRA, and at Table Rock Financial Planning we like to see people making the most of the opportunities this flexible, tax-favored investment account offers. Below are a number of key advantages of Roth IRAs and why we recommend them so often.

First, if you are not familiar with Roth IRAs, go here for quick summary and here for a more detailed discussion and comparison with traditional IRAs.

Accessibility of your funds in a Roth IRA

There is often a conflict, especially for younger investors, between establishing a healthy emergency fund (e.g. 3 to 9 months of expenses), saving for major purchases, and contributing to a retirement account. A key feature of the Roth IRA is that the contributions you have made to fund your account are always accessible to you--tax-free and penalty-free. Although a Roth IRA isn't a substitute for a liquid FDIC insured savings account, it is a great back-up. A young investor may choose to keep a somewhat smaller savings account for contingencies, and more aggressively fund a Roth IRA, knowing that in-a-pinch they can access much of the Roth funds (their contributions, not the earnings) without a tax hit. Although the main purpose of IRAs is to put your money aside and let it grow tax free for many years, knowing you can get to the money may allow you juggle multiple financial objectives and to sleep better at night. A few other items related to the accessibility of money within a Roth IRA:

- After a Roth IRA has been established for five years*, an investor can take out up to $10K for the purchase of a first home. This distribution is tax and penalty free, even if some of this money is from earnings, not just contributions. A couple could take out $10K each from their individual accounts, providing up to $20K for a healthy down payment. (If the Roth has not been established for five years, there will be taxes on any earnings, but still no penalty.)

- After a Roth IRA has been established for five years*, investors can access funds to help pay for their children's college. Any portion of the distribution attributable to earnings will be taxed, but there will be no penalty. There are probably better ways to save for college, but sometimes this may be a reasonable option.

- If the account owner dies or becomes disabled ("total and permanent" Social Security definition of disability) the money in a Roth IRA will be available tax-free.

- After you turn age 59.5, all distributions are tax and penalty free as long as the Roth has been established for 5 years*.

- Although your contributions to the Roth IRA are accessible tax-free, different rules apply to funds that have been converted from a traditional IRA.

The ability to save more in tax-favored accounts

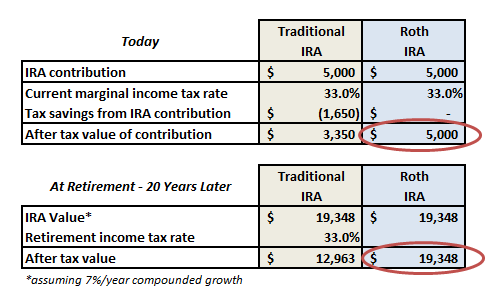

Contributing to a Roth IRA (or Roth 401k or Roth 403b) allows you to effectively save substantially more into tax-favored accounts than with traditional IRAs (or 401k or 403b). To understand this, look at the following simple example:

Note that when you contribute to a Roth IRA you are saving more on an after tax basis than when you save the same amount into a traditional IRA. In order to save the same amount, the person who uses the traditional IRA must also invest the tax savings ($1,650 in this example). However, since the individual is limited to only a $5,000 IRA contribution, the additional $1,650 would need to be invested in a taxable account. The combination of the a traditional IRA and taxable account, even if the taxable account is invested tax efficiently, will generally not be as valuable as the Roth IRA. (The exception to this will be when tax rates are expected to be considerably lower in retirement.)

Tax management in retirement

Many people do precious little thinking on managing their current tax situation, let alone consider how they will minimize their taxes in retirement. If all of your retirement accounts are traditional IRAs (including roll-overs from employer retirement plans such as 401ks), all of your distributions will be fully taxable. If you need to withdraw additional money in a particular year, you will increase your taxable income and probably your tax liability. However, if you have the option of tapping funds in a Roth IRA instead, you can take a larger distribution without negatively impacting your tax situation. Some other tax considerations to note:

- Additional traditional IRA distributions may move you into a higher tax bracket, and possibly cause a higher percentage of your Social Security benefits to be taxed. This interaction with Social Security, and possibly even Medicare, can make the marginal tax impact of an additional distribution much higher than you would normally assume.

- Also, higher income associated with higher taxable distributions cause tax deductibility thresholds (e.g. the 7.5% of AGI threshold to deduct medical expenses) to be higher--in effect lowering your deductions and increasing taxes in another way.

- Unlike the Roth IRA, it is important to note that traditional IRAs are subject to required minimum distributions (RMDs). Even if you don't need the money from your traditional IRA, you will be required to take distributions and pay taxes after you turn age 70.5. These RMDs are a bit of a hassle to keep track of, and it is possible to make mistakes and incur significant penalties.

The Roth IRA also gives the investor an advantage often referred to as tax-diversification. Are you concerned that income tax rate may go up in the future? Many people are, and paying taxes today effectively locks in the rate that you pay--allowing you to shield yourself from the risk of higher future rates. (It is important to note that if you expect lower income in the future, you may still pay a lower income tax rate in retirement--even if Congress raises taxes.

These aren't the only things to like about the Roth IRA. The Roth is more straight-forward, easier to understand, and easier to manage long-term than traditional IRAs. And, if you plan on passing along IRA assets to your loved ones, it is to their advantage to inherit a Roth IRA, where the taxes have already paid. If you aren't taking full advantage of the opportunity Roth IRAs provide, it will pay to take a closer look.

For information on converting traditional IRA assets to a Roth IRA, look here.

-------------------------------------------------------------------------------------

*This five year period (or five year rule for withdrawals) is defined as beginning with the first taxable year for which the account holder has a Roth IRA contribution of any kind. There is a different five year rule that pertains to Roth conversions, and the difference is explained in this article.

Next page: Disclosures