Financial Planning Blog

Keeping It Simple

Keeping It Simple

There is no getting around the fact that personal finances can get downright complicated. Retirement accounts, Social Security, insurance, paying for college, and investments are all complex. Making your retirement nest egg last over an uncertain lifetime is a thorny issue. And, if your eyes haven't glazed over yet, you still have taxes and estate planning to consider.

That is why I respect people who can cut through the difficulties and make some big concepts simple. Let me direct your attention to a couple of guys I really appreciate.

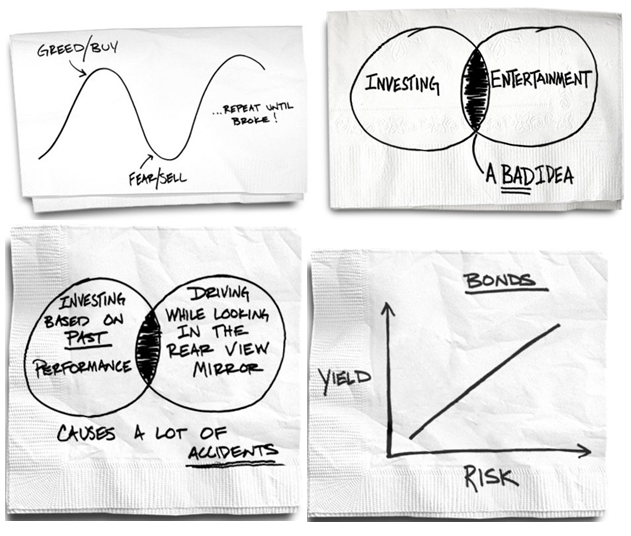

Carl Richards' BehaviorGap.com

Carl Richards is a Certified Financial Planner and investment manager (Prasada Capital Management) who knows how to keep it simple. He started writing about what he calls the Behavior Gap--why the average individual investor tends to do so much worse than the overall market performance. His blogs are insightful, but what is truly remarkable is his ability to reduce the complex topics of investor behavior and our relationship with money down to a sketch on back of a napkin. A few of my favorite examples are shown below, but you are encouraged to check out the BehaviorGap.com website and subscribe sign up for his newsletter. Also, you can check out his blog, including past articles and sketches at the New York Times Your Money section.

Sketches by Carl Richards

Bill Schulthieis' The Coffeehouse Investor

The Coffeehouse Investor is both a website and a short, easy to read book by Bill Schultheis, a Seattle area investment manager (Soundmark Wealth Management). The subtitle is: How to Build Wealth, Ignore Wall Street, and Get on with Your Life. What I like most about the Coffeehouse Investor is the attitude--ignoring the hype of Wall Street and getting on with our lives. We can make things much more complicated, but you will do well to follow The Coffeehouse Investor's three principles of investing:

- Save for a rainy day. (Develop a long term financial plan)

- Don't put all your eggs in one basket. (Diversify in different asset classes.)

- There is no such thing as a free lunch (Capture the entire return of each basket, or asset class, through low cost index funds).

Sure, this isn't all there is to know about investing or personal finance, but it's a big part of it. And, if you don't build a foundation on solid principles like these, the rest isn't going to matter. Check out the CoffeehouseInvestor website and sign up for the e-newletter. (Too bad he doesn't have any cartoons.)

Next page: Disclosures