Financial Planning Blog

Value vs Growth Stocks for the Long Run (Part 1)

Value vs Growth Stocks for the Long Run (Part 1)

Are you a value investor or a growth investor? Do you, or should you, care?

Stock market investing is often categorized into a couple of "style" camps--value or growth. Value stocks are those with a price that is lower relative to the investment fundamentals of the company--things like earnings, book value, cash flow, and dividends. In essence, you are paying less for a dollar of earnings. In contrast, growth stocks are those with better growth prospects, but you pay a higher price relative to the current fundamentals. Growth stocks have a "good story", and are sometimes referred to as "glamour stocks". Value stocks are sometimes considered boring--unless, of course, they are in danger of going under. Then they may be very exciting, but not in a good way. With growth stocks you think of companies like Netflix and Amazon. With value stocks you thing of Idaho Power (IdaCorp) and Ford. (Yawn.)

Although you would think that growth stocks would provide higher returns over time, this is not the case in the aggregate. The long term data in the US and in international markets is that value stocks have out-performed growth stocks consistently over the years.

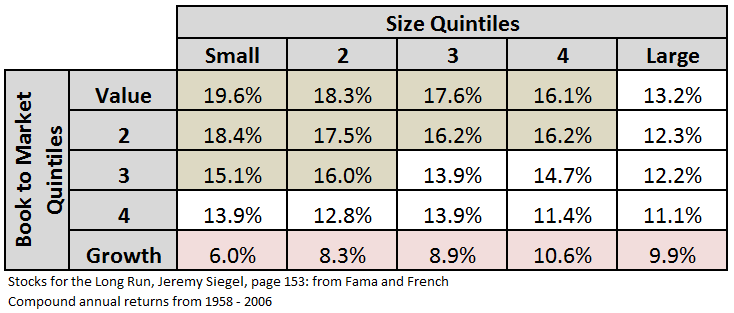

Here is some interesting historical data for you to chew on. In Stocks for the Long Run, Wharton professor Jeremy Siegel breaks down the US stock market by company size (5 quintiles) and style (5 quintiles of value/growth) criteria. He ends up with 25 groups of stocks of varying style and size characteristics. In each of the 25 groups he has calculated the average compound annual return from 1958 through 2006, as shown in the table below.

On the right, you have the largest mega cap companies in the S&P 500. On the far left would be considered micro cap stocks. In the middle are small, mid cap, and large companies. From top to bottom you move from companies with considerable value characteristics down to the most extreme growth stocks. As you can see, in all the size quintiles, value has out-performed growth over this extended time period. And, even though this "value premium" is noteworthy on large stocks, it is even more pronounced in small and midsize companies.

As an investor who understands that expected return and risk and are inextricably related, it may be reasonable to assume that if value stocks produce higher returns over time, then value stocks must be riskier than growth stocks. However, using the most common measure of financial risk (standard deviation of returns, or volatility), we find that is not the case. Value stocks have been shown to have lower volatility than growth stocks. In other words, they are less risky--at least by this measure.

Economists argue about whether the market is efficient in relation to this value effect, or if there is some additional element of risk associated with value stocks that is not captured by the traditional measures, but is still priced in by investors*. William Bernstein presents an interesting discussion of the risk of value and growth and concludes "that although value and growth both have their unique risks, those of growth stocks are more regular and pervasive. During a depression, growth companies may hold up better than value companies...But, when bubbles burst, you can take to the bank that growth will get whacked more than value."

In Part 2 we'll look at some more data on the persistence of the value premium, and discuss the potential implications for your portfolio.

-----------------------------------------------------

*In the 1990's economists Eugene Fama and Kenneth French proposed that about 95% of the expected return of a diversified stock portfolio was determined by its exposure to three risk factors: 1) overall market or systematic risk, often referred to as "beta", 2) the percentage of small cap stocks by market weight, and 3) the percentage of value orientation by market weight. The data shown above illustrates both these small company and value effects.

Next page: Disclosures