Financial Planning Blog

Single Fund Solutions--Target Date Funds (Part 2)

Single Fund Solutions--Target Date Funds (Part 2)

Sometimes you just want a simple solution to your problem so that you can get on with your life. In Part 1, we looked at situations that called for the simplest of investing options--single mutual funds that provide a diversified portfolio appropriate for a variety of circumstances. These funds come under different labels--balanced funds, asset allocation funds, all-in-one funds, life-cycle funds and target-date retirement funds are the most common. Let's explore single fund investing solutions so you can determine if they may make sense for your situation.

Single fund investing solutions, or all-in-one funds, offer broad diversification both across various asset classes (e.g. stocks and bonds of various characteristics) and within asset classes (many different stocks and bonds from many diverse issuers). The investor could choose to get that level of diversification by using many mutual funds with different investment objectives, but the all-in-one fund provides the convenience of a single fund. Although all-in-one funds each seek to provide a broad level of diversification, they can then be split into two basic categories:

1. Target-date funds: Sometimes referred to as life-cycle funds, these funds set an asset allocation that is appropriate for an objective at a future point in time. The unique characteristic of the target-date fund is that the fund's asset allocation is dynamic--shifting to a more conservative allocation as the target-date objective gets nearer. (Target-date funds will be discussed further in this post.)

2. Balanced or asset allocation funds: These funds provide an asset allocation that is independent of any time-based objective. You can find balanced funds with conservative, moderate, or aggressive asset allocations, and these funds will presumably have the same or similar asset allocations 10 or 20 years in the future. (Balanced or asset allocation funds will be examined in Part 3.)

Target-Date Funds

Target-date retirement funds actually are a series of funds with varying target-dates for your retirement. It is common to see a series of about a dozen funds with target dates ranging every 5 years, say from 2005 to 2055, plus an income fund appropriate for those who have retired prior to 2005. The first series of target-date funds was introduced by Barclay's in 1993, and they have steadily gained in popularity. Today, over 25 different mutual fund families have target-date series. Although you will find them offered in the majority of employer sponsored retirement plans, you can also buy them as an individual investor through the fund company or a fund supermarket like Charles Schwab or Fidelity. Typically, target-date funds are "funds-of-funds", meaning that the target-date fund holds several underlying mutual funds.

When selecting a target date retirement fund you should give consideration to the following points:

- Is the fund's asset allocation aggressive or conservative? Every target-date fund has an asset allocation that the provider believes is appropriate for an investor with the assumed objective of retiring at a particular point-in-time. For example, a 2025 fund from Vanguard has an asset allocation of 74% equities and 26% bonds. To many this seems reasonable for a 50-55 year-old thinking of retiring in 14 years, but to others it may seem a bit aggressive. The investment managers at American Century advocate a more conservative approach and have only about 60% of their LIVESTRONG 2025 Portfolio invested in stocks. On the other hand, T.Rowe Price's 2025 fund is even more aggressive than Vanguard, with over 78% in stocks and only 22% in bonds. It shouldn't come as a shock that equally smart, reasonable people have different opinions of what is smart and reasonable when constructing an investment portfolio that balances expected risk and return for an individual.

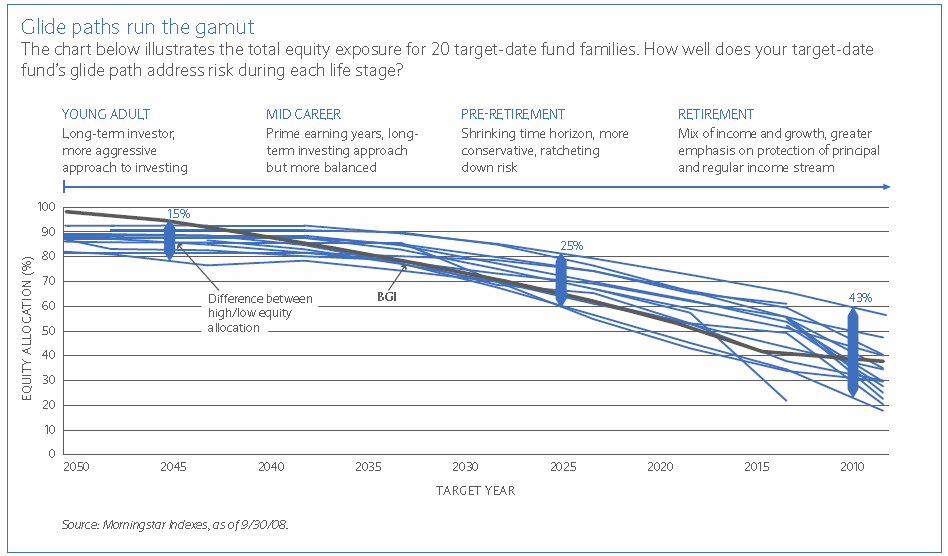

- Is the fund's asset allocation "glide path" one you are comfortable with? Not only are you concerned with whether the target-date fund's current asset allocation is acceptable to you, but you need to be aware of how this asset allocation is going to change over time. This is what is referred to as the "glide path"--in other words, how the fund transitions to a more conservative portfolio as the target-date approaches, or is passed. As already noted, funds take very divergent approaches and it is amazing how the "equity landing point" (i.e. the percentage in stocks at the target date) differs among providers. This graphic from Barclay's Global Investors illustrates the vast differences in asset allocations and glide paths between funds. Note that biggest differences between funds occurs at the equity landing point where the most aggressive funds have more than 60% in equities and the most conservative ones under 30%.

This great discrepancy of asset allocations as you near retirement led to much controversy concerning target date funds after recent major downturn. Apparently, many investors thought having their money in target-date funds--funds that were supposedly transitioning to more conservative portfolios as they neared retirement--would protect them better when the market cratered. Although the target-date concept is a pretty sound one, the actual performance in various markets is dependent upon the implementation. And, it is certainly not a guarantee that you will not lose money in a down market. This is why you need to pay attention and choose a fund you can live with.

- What are the underlying funds? Beyond the top level differences in the stock/bond allocation, there can be major differences in the number and type of underlying mutual funds. Some target-date funds, like Vanguard's, consist of a small number of highly diversified, low cost index funds. Others consist of ten or twenty actively managed funds that cover many different corners of the market. There isn't necessarily a correct recipe, but you may have personal preferences regarding active versus passive management. Also, you may have opinions on the amount of international or emerging market exposure you desire, or possibly the addition of international or inflation protected bonds.

- How much are you paying for this convenience? In the mutual fund world, costs matter. They are not the only thing that matters, but the less you pay for managing the underlying investments, the more money is left for you in retirement. (See this earlier set of posts on pesky mutual fund expenses.) There is a sizeable range of costs for target-date funds, and since these are funds-of-funds, you want to make sure you are comparing the total cost--the cost of underlying funds plus any additional expenses to manage the target-date portfolio.

- You don't have to use the fund with your "target-date". There is no requirement or for you to use the fund recommended for your expected retirement date. It may make sense for you to use a fund with a target-date that is earlier or later than your anticipated retirement. For example, maybe you really like Vanguard or T. Rowe Price's retirement funds (both are Morningstar analyst picks), but both are on the aggressive side. You could still choose these families, but select an earlier target date in order for the allocation to be a bit more conservative.

This certainly isn't everything there is to know about target-date funds. Hopefully, it is a good rundown on what you need to know to get started. These funds are simple and convenient, and offer the benefits of a professionally managed asset allocation that adjusts automatically over time. By putting your investments on auto-pilot you may also be insulating yourself from many common investor errors, such as failing to maintain an age appropriate asset allocation, failing to rebalance your accounts, chasing hot funds, or bailing out of the market at inopportune times.

In Part 3, we'll explore the second category of single fund solutions, balanced (or asset allocation) funds.

Next page: Disclosures