Financial Planning Blog

Safe Withdrawal Rates—Why The 4% Rule May Be Too Conservative (Part 2)

Safe Withdrawal Rates—Why The 4% Rule May Be Too Conservative (Part 2)

In days gone by many retirees could rely on the three legged stool of retirement income--Social Security, personal savings, and company or government pensions. For private sector workers especially, this third leg--employer defined benefit pension plans providing guaranteed lifetime income--is becoming increasingly rare. More and more retired people are now required to manage their personal savings (often accumulated in IRAs or employer defined contribution plans like 401Ks) to cover a majority of their expenses over a potentially long retirement. This is not an easy task, and it isn't obvious how much retirees can spend each year from investment portfolios without running the risk of running out of money before running out of years (i.e. shortfall risk).

In Part 1 a popular rule of thumb for sustainable portfolio withdrawals, the 4% rule, was discussed. Now calling the 4% rule "popular" is a bit misleading. It is popular in the same vein that other often repeated rules like "floss daily" and "stay within 5 MPH of the speed limit" are popular. People don't like the 4% rule because it seems very conservative, very restricting, and a major obstacle to enjoying retirement. When they realize that the 4% rule implies you need a portfolio 25 times the beginning portfolio withdrawal-people exclaim, "No way, that is just not going to happen!"

Never fear, many respected financial planners agree that the 4% rule is a bit too cautious. Below is a brief rundown of some of the criticism.

Some reasons the 4% rule may be too conservative

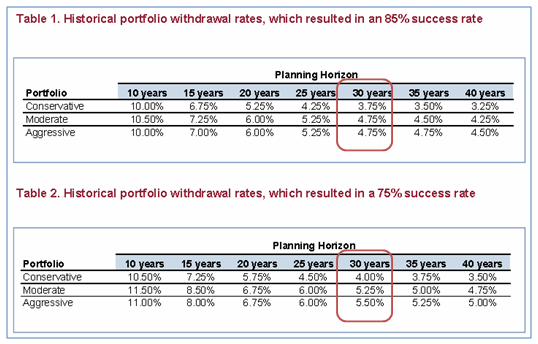

First of all, the historical data shows with a beginning withdrawal rate of 4%, portfolios would have successfully sustained inflation adjusted withdrawals for 30 years 90%-95% of the time. As the following Vanguard tables show, 4.75% to 5.25% withdrawal rates (with moderate -- 50% stock/50% bond portfolios) were sustainable over 30 years with 75% or 85% success rates. (Not bullet-proof, but successful most of the time.) In fact, you'll often hear the 4% rule quoted as suggesting beginning withdrawals of 4.5%, or 4% to 5%.

Research Note: Revisiting the ‘4% Spending Rule' (Portfolio allocation: Moderate portfolio = 50%/50% stock/bonds, Conservative portfolio=20%/80%, Aggressive=80%/20%)

A common, and valid, criticism of the whole "safe withdrawal rate" concept is that a static withdrawal rate over 20-40 years is simply unrealistic. Or, as Moshe Milevsky says, "...a simple rule that advises all retirees to spend x% of their nestegg, adjusted up or down in some ad hoc manner, is akin to the broken clock which tells time correctly only twice a day." Certainly, retirement expenses are not linear over time, and many argue that expenses are often higher in the early years of retirement when people are more active. Maybe rational retirees would prefer to have more spending early in retirement, and willingly accept lower spending budgets later in retirement, if necessary. To impose a 30 year linear budget is not only a bit rigid, but will more likely than not, result in a substantial surplus at the end of the plan.

If you are flexible and disciplined, you can do better than starting out with only a 4% portfolio withdrawal rate. You simply have to be willing and able to cut back if subpar portfolio performance demands it. Jonathan Guyton has done some of the best research defining relatively simple decision rules governing spending rates which, if followed, can significantly increase the beginning withdrawal rate. Guyton starts with a basic withdrawal rule that says withdrawals are modified upward for inflation, except following years where the portfolio return is negative. Any missed inflation adjustments are not "made-up", but he has two other decision rules (or "guardrails") that work to keep withdrawals from becoming too high or too conservative. The first guard rail is the capital preservation rule which calls for a 10% reduction from the previous year's withdrawal when the withdrawal rate gets too high (20% above the starting rate). In good times the prosperity rule kicks in, calling for a 10% increase in withdrawals when the current withdrawal rate drops too low (20% below the beginning rate). Guyton's research says that these decision rules will provide for 30 year withdrawal periods at beginning rates ranging from 4.6% to 6.5%, with the expectation that the capital preservation rule (i.e. 10% cuts) is triggered no more than 10% of the time. The lower starting withdrawal rate is for moderate portfolios (50% stock) and very high probability for success. The higher starting withdrawal rates require higher allocations to stock and/or somewhat lower probabilities of success (but still 90% or above).

Finally, another bit of research that points to potentially higher safe withdrawal rates was done by influential financial planner Michael Kitces in 2008. Kitces drew on research that has shown an "incredibly strong inverse relationship" between the starting price to earnings ratio of the S&P 500 and the following 15 year returns. Since it is sequence risk, or the risk of lousy market returns during the first 15 years of retirement, that deplete portfolios prematurely, P/E ratios could be an excellent predictor of potential failure. (The analysis uses a P/E ratio based on the 10 year average of real earnings, referred to as P/E10 or CAPE-the Cyclically Adjusted Price Earnings Ratio.) Indeed, Kitces found that "the only instances in history that a safe withdrawal rate below 4.5% was necessary all occurred in environments that had unusually high P/E 10 valuations (above 20). "When stocks markets have more normal valuations (P/E 10 between 12 and 20), Kitces recommended adding 0.5% to the beginning safe withdrawal rate, to 5.0%. When stocks are undervalued (P/E 10 less than 12), the beginning safe withdrawal rate could be bumped 1%, to 5.5%.

It is encouraging that if you are willing to be flexible and disciplined, and you are fortunate to be retiring when stocks are not highly overvalued, you may be able to take higher levels of income from your portfolio than the 4% rule demands. However, before you go rush out and buy that RV or lake house, see some of the reasons you may still want to remain a bit conservative.

Next page: Disclosures