Financial Planning Blog

Single Fund Solutions: Balanced Funds (Part 3)

Single Fund Solutions: Balanced Funds (Part 3)

Would you rather be researching mutual funds or riding your mountain bike in the Boise foothills? OK, maybe slogging your way up the south side of Table Rock isn't your idea of fun, but "normal" people don't look forward to studying Morningstar mutual fund reports or figuring out how to rebalance their portfolio. Balanced, or asset allocation, funds are possibly a great solution for the person who has some money to put to work, but would rather invest their time elsewhere.

Balanced (or Asset Allocation) Funds

Balanced funds are often considered boring. Generally speaking, they are mutual funds on training wheels--designed to keep investors on-track with a sensible, diversified portfolio. They are a type of single fund investing solution, or all-in-one fund, that spreads the investors' money across various asset classes (e.g. domestic and international stocks and bonds) and within asset classes (stocks and bonds from many different issuers). In Part 2, we examined target-date retirement funds--single fund solutions that dynamically shift to more conservative asset allocations as the investment objective (retirement) draws near. Balanced funds are similar, however they provide an asset allocation that is independent of any time-based objective. In other words, it will not be shifting to more conservative allocations just because time is passing by. You can find balanced funds with conservative, moderate, or aggressive asset allocations, and these funds will presumably have the same or similar asset allocations 10 or 20 years in the future.

Some asset allocation funds have distinct portfolios of stocks and fixed income investments. Others, similar to most target-date portfolios, are funds-of-funds. This means that they consist of a number of underlying mutual funds that invest in various parts of the stock and bond markets. Sure, you could probably go purchase all the underlying funds yourself, but buying the balanced fund makes the initial and subsequent purchases easier. And, no matter how the balanced fund is constructed, it is the fund manager's job to keep the fund's portfolio in-line with its asset allocation target. This relieves the investor of the burden of rebalancing, an important investing discipline that keeps helps control the level of risk in your portfolio and offers the potential of marginally increased returns. This automatic rebalancing, along with the increased tendency for balanced fund investors to buy-and-hold the investment through market cycles, helps them realize a larger portion of potential returns.

Although balanced funds are simple investments to buy-and-hold, there are a large variety of these asset allocation funds available in the marketplace, and this can make the initial selection daunting. Here are some of the considerations to be aware of in searching for the right fund for your preferences and situation.

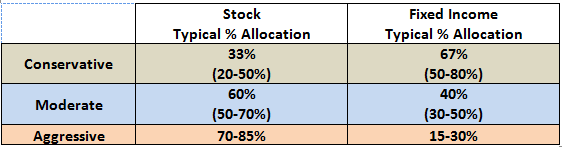

- How much risk are you willing to take? Balanced funds are differentiated by their asset allocation--most importantly what proportion of the portfolio is dedicated to equity investments (for more growth potential) and what proportion is in fixed income or other defensive assets. Morningstar categorizes asset allocation funds as follows:

The sweet spot for balanced funds is in that moderate allocation category, with about a 60% stock and 40% bond allocation. However, be aware that not all balanced funds are targeting this moderate profile.

- Is the fund's asset allocation strategic or tactical? Most asset allocation funds set a strategic allocation to various asset classes and only deviate within relatively narrow bands. In other words, the asset allocation remains relatively static. Others are tactical asset allocation funds, where managers have broad discretion on how much is invested in each asset class. The hope is that the fund managers can tactically move between various types of investments given their assessment of opportunities and risks. Although these tactical allocation funds may sound appealing, realize that they won't necessarily perform better than a static allocation. It is extremely hard to consistently time market moves--if it was easy, everyone would be doing it successfully.

- How much is the convenience of a single fund costing you? Whenever you are investing you should be aware of the underlying costs. Similar to target-date funds, there is a wide range of costs associated with investing in balanced funds, or any mutual fund. Be aware that higher costs are a substantial headwind that makes progress toward your goals more difficult.

- Do you want passive or active management? Some balanced funds passively follow a balanced index, while others consist of a collection of underlying index funds. These passively managed funds focus on providing investors with broad diversification and exposure to an appropriate asset allocation at a very low cost. Other funds are actively managed, with the objective on selecting a smaller number of stocks and bonds in hopes of beating a benchmark. Still others (e.g. Vanguard's Life Strategy Funds) take a hybrid approach, combining passive and active management. You can be successful either way, but it is wise to understand how the fund is managed and have the correct expectations of its performance versus various benchmarks.

- How much international exposure is there? All asset allocation funds will be diversified across stocks and fixed income investments. One area where there can be wide variation between funds is the amount of exposure to international stocks and (to a lesser extent) bonds. For example, Vanguard's Balanced Index Fund has 60% of its portfolio in stocks--but only U.S. based companies. In contrast, another passively managed balanced fund with 60% in stocks, Schwab's MarketTrack Balanced Investor has a healthy allocation (15%) in international stocks. And, actively managed American Funds Capital Income Builder has 40% of its portfolio in international stocks, along with its 30% stake in domestic stocks. In general, most would agree that a healthy exposure to international equities (including some in emerging markets) is a key component of a diversified portfolio. (In fairness to Vanguard, they have a number of other all-in-one funds with reasonable international diversification.)

As is often the case with any type of automatic or "simple" solution, when you look under-the-hood things are a bit more complex. Hopefully, considering the factors discussed above will help you in selecting a balanced fund that meets your needs. Ultimately, choosing to go with an all-in-one fund, whether it is a target-date or balanced fund, is a decision to go with a "good enough" plan that will be executed very well. This is opposed to the perfect plan (e.g. your brother-in-law's 30 fund portfolio) that runs a substantial risk of poor execution. As stated in this recent Morningstar article on investor returns: "Balanced funds may not be entertaining, but if they keep you from doing stupid things you could learn to love them."

Next page: Disclosures