Financial Planning Blog

Safe Withdrawal Rates—Maybe the 4% Rule Should be the 3% Rule (Part 3)

Safe Withdrawal Rates—Maybe the 4% Rule Should be the 3% Rule (Part 3)

In the last post we explored a number of reasons why the 4% rule may be too conservative. Although it would be nice to leave you on such a positive note, it is worthwhile to balance this with a more cautious perspective.

Why a 4% safe withdrawal rate may be too optimistic

Most safe or sustainable withdrawal rate studies are based on historical data, and the general assumption is that future returns will be similar to the past. Two issues with this approach are identified by a number of researchers.

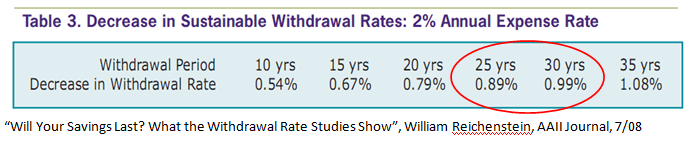

First, many (but, not all) safe withdrawal rate studies ignore the impact of that investment costs have on investor returns. On average, investors will not earn the gross return to stock market index, but rather a net return after costs. Between mutual transaction costs, mutual fund expenses, and potentially investment management fees, it is easy to imagine a drag of at least 1% to 2%. William Reichenstein of Baylor University calculates that if you assume investment returns are 2% lower than the historical gross (i.e. before investment costs) returns, then sustainable withdrawal rates over 25 to 30 year periods are about 1% lower. In other words, your 4% to 4.5% safe withdrawal rate becomes 3% to 3.5%.

Second, there is no guarantee that future market returns will be as generous as the past hundred or so years of data. In fact, many influential investment managers and economists expect lower market returns over the next ten to twenty years. They point to historically low dividend yields, high stock market valuations (i.e. price to earnings ratios, or the amount investors are paying for a dollar of corporate earnings), low interest rates, and concerns over future economic growth as harbingers of lower future stock and bond market returns. Here is a sample of prominent voices on this subject:

- John Bogle, founder of Vanguard, expects future stock market returns to be around 7%, compared to historical returns or 9% to 10%. In a 2009 Morningstar video he stated: "I think we give far more credence to past returns in the stock market than they even remotely deserve. The past is not prologue. The stock market is not an actuarial table." Rather than looking at past returns, Bogle says we need to focus on the sources* of past and future stock market returns. We can, and should, have reasonable and rational expectations of these sources of returns.

- Ed Easterling of Crestmont Holdings points to relatively high stock market valuations, the current low interest rate environment, and uncertainty of future economic growth as reasons to be very cautious with future expectations. In a recent Wall Street Journal article he says, "Retirees, especially those that started in the recent past, have a relatively long period ahead of them. Over-assumed returns can empty savings more quickly than many expect." With the conditions of the past few years, he believes a safe withdrawal rate is 3% or less. (If you have access to the AAII Journal, see Easterling's September, 2011 contribution: "Historical Performance and Future Stock Market Return Uncertainties.")

- Rob Arnott and John West of Research Affiliates also don't believe future returns will match expectations set blindly on historical data. In "Hope is Not a Strategy" they derive baseline return assumptions for large U.S. stocks of only 5.2% (or a 3.2% real return after inflation). For bonds, they have a baseline assumption of only 2.5%. "The only way today's expected returns can match tomorrow's targeted returns is through remarkable good fortune in the years ahead. We're relying on hope. But hope is not a strategy; hope will not fund secure retirements. We're planning for the best and denying that worse can happen. It makes far more sense to hope for the best, with plans for realistic outcomes-and contingency plans for worse ones."

- Bill Gross of PIMCO has been talking about a "new normal" period of slower economic growth and lower market returns for both stocks and bonds. "Instead of 10% returns for stocks, look for five or so. And instead of the past 20 years' returns on bonds, which are actually better than stocks -- close to double digits -- it's 4% going forward. So that's what the new normal is. And it's based upon the primary assumptions of a deleveraging of the private sector and the public sector being limited in what it can spend."

This just brings home the fact that future market returns are not some sort of entitlement. We don't know what the next 10 to 20 years has in store in regards to market returns, but it is probably unwise to presume that the future will deliver historically healthy results. Although the concept of a safe withdrawal rates is a tool to deal with these risks and uncertainties, there may be reason to be a bit more cautious. (For one such cautious approach, see this video where Ken French of Dartmouth discusses establishing a safe withdrawal rate starting with Treasury Inflation Protected Securities, or TIPs.)

As discussed in Part 2, it is unrealistic for someone to set a withdrawal rate and leave it untouched for 30 years. For a successful outcome (i.e. one that doesn't involve moving in with your children or becoming a regular at the food bank), it is important to be attentive and flexible. If the markets are not delivering adequate returns over the first critical 10 to 15 years of retirement, you will certainly be getting real time feedback on your account statements. If that doesn't alert you to cut back a bit on spending, take the hint when your financial advisor suggests you look into jobs at Walmart.

----------------------------------------------------------------------

*Bogle breaks the the sources of stock market return into:

- Investment return, which comes from initial dividend yield and future earnings growth.

- Speculative return, which comes from the change in the public's valuation of stocks, measured by the price/earnings ratio--basically how much investors are willing to pay for each dollar of corporate earnings.

Next page: Disclosures