Financial Planning Blog

Do you know someone who is struggling under the burden of student loan debt? With about two-thirds of graduates leaving college with an average of over $23,000 in student loans, there are many individuals and families dealing with the long term implications of education indebtedness. Although student loans, when used conservatively, can be a significant aid in helping some students finance their education, they have become curse to many. The poor economy and high unemployment of recent years has made a difficult situation worse.

There are many federal programs in place to assist people with repayment of their student loans, and struggling borrowers should familiarize themselves with their features to determine if they are a good fit for their situation. Meanwhile, the rest of us can sit back and debate whether these programs are a wise public investment, or simply another public bailout out of an additional group of irresponsible borrowers.

Income Based Repayment (IBR)

In an effort to keep loan payments affordable to borrowers, a new repayment option is available to many. The Income Based Repayment option does two big things for those with federal student loans (not private loans or parent PLUS loans) who apply:

- It keeps loan payments down to an affordable level. Federal student loans payments will be capped according to a scale based on income, family size, and state of residence. Currently the loan repayments are set at just 15% of the amount a borrower's adjusted gross income (AGI) exceeds 150% of the poverty level. This can result in significantly lower monthly payments, and in the case of very low income or large families, even zero payments. For most borrowers, the monthly payments will be under 10% of their income. Whatever the payment, it will be less than the standard 10 year loan amortization payment, or else you won't qualify for the program. And, if the newly calculated payment is not high enough to cover the interest on the loan, your Uncle Sam will even pay the interest on Subsidized Stafford Loans for up to three years. For other loans, and after three years on the Stafford ones, the interest will accrue and be added to the loan balance. Of course, this may not matter because of #2.

- The remaining loan balance is forgiven after 25 years of qualifying payments. This is a long time to make payments, but at least there is a final resolution. In the meantime, payments have been kept at a manageable level. Be aware, the amount of loan forgiveness is taxable in this program, although there is talk about changing this.

The Student Aid and Fiscal Responsibility Act (you have to love the name) that was included in the recent health care reform bill (any obvious connection?), makes this deal a bit sweeter after 2014. It drops the 15% income cap to 10%, and the 25 years to 20 years for forgiveness.

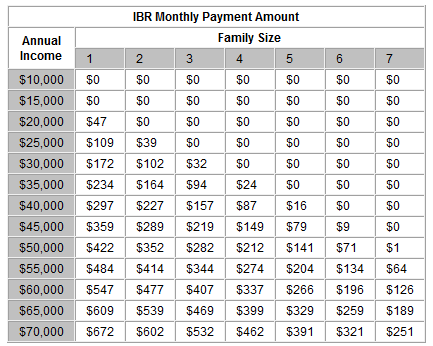

Below is a chart from the Federal Student Aid website that shows the maximum monthly payment for various income and family sizes. Let's take a look at potential benefit from the program to the average new graduate with $23,000 of federal student debt, say at 5% interest. Paying off that debt over the standard 10 years would require payments of about $245/month. If this graduate was part of a family three, earning $40,000/year, the payment would be limited to less than $160/month-a reduction of at least $85/month. Of course, our graduate will still be paying on the loan for long after 10 years, if she doesn't eventually ramp up her payments.

From: www.studentaid.ed.gov

Public Service Loan Forgiveness (PSLF)

With the IBR program, the borrower must wait for 25 years before the loan is finally cancelled. However, for graduates who work in a wide range of "public service" jobs, forgiveness is accelerated to just 10 years. Public service employment includes federal, state, and local government jobs, along with non-profit, tax exempt 501(c)(3) organizations. Employment must be considered full time, and documentation of employment will be required. Keep good records!

Like the IBR, the Public Service Loan Forgiveness program is only available for certain federal loans--Stafford, Grad PLUS, or consolidation loans in the Direct Loan program. Only payments made after October 1, 2007 count toward the 10 years (or 120 monthly payments). The borrower does not need to be participating in the IBR plan--although it definitely may make sense if they are eligible.

Other Federal Loan Forgiveness Programs

Besides the PSLF, there are many other federal loan forgiveness programs available to certain occupations. One popular program is for full-time teachers in elementary or secondary schools designated as serving a high percentage of low income families. (For the surprising long list of eligible Idaho schools, click here.) Up to $5,000 of Stafford loans are forgiven for teachers who have served for 5 consecutive years in a qualifying school. For secondary math and science teachers, or special education teachers, the amount of loan forgiveness is $17,500 after 5 years. Up to 100% of Perkins loans can be forgiven in a similar program.

A surprising number of other forgiveness programs are available, including those offered by the National Guard, the Peace Corps, AmeriCorps and VISTA. Go here for links to information on these and programs geared toward medical and legal professionals.

In Part 1, the key disadvantages of an UGMA/UTMA custodial account for college savings were listed. In recent years many people have taken advantage of the capability to transfer custodial assets into Section 529 college savings plans as a way to overcome at least some of these drawbacks.

Transferring a custodial account to a 529 plan

The custodian of an UGMA/UTMA account can move the assets to a 529 plan, but a number of restrictions generally apply. Most 529 plans, including IDeal, require the transferred assets be set up in a separate "custodial Section 529 account", so they cannot be combined with other 529 contributions. The "custodial 529 account" will still be subject to UGMA/UTMA restrictions, most importantly:

- The beneficiary/child will still gain control of the account at age 18.

- The custodian cannot change beneficiaries, unlike a normal 529 account.

For more details on moving assets from an UGMA/UTMA account into IDeal, see pages 12-13 in their disclosure statement.

Although transferring the custodial assets to a 529 plan does not eliminate these account control issues, there are a couple of potential advantages.

- Even though the custodial 529 account becomes the student's asset at 18, for financial aid purposes it will be counted as the parents' asset and assessed at only 5.64% for the EFC. (As explained in this article, this treatment of custodial 529s is new starting in 2009.)

- Depending on your family's situation, moving the money into a 529 account could help the student qualify for more financial aid than if the money is left in the original custodial account. As long as the assets are used for qualified educational expenses, the tax benefits of a 529 plan are superior to those of an UGMA/UTMA custodial account. The amount of the potential tax benefit will depend on investment returns, how long the funds are invested, and the family's tax situation.

A couple of more things to consider before transferring custodial funds into a 529 plan:

- The 529 plan can only be funded with cash. This means that the custodial assets must be liquidated before transferring them into the 529 plan. The tax implications of this liquidation should to be considered before going forward.

- Don't wait too long to do the conversion. You obviously want to have this done prior to completing the FAFSA (Free Application for Federal Student Aid). Also, if the liquidation of the custodial account creates significant realized income, you probably don't want that to show up on the tax return used for the FAFSA.

The concept of starting early to save for college expenses is pretty simple, but following through with the disciplined savings is the real work. If you have planned ahead, diligently saved, and utilized tax favored accounts--great job! Unfortunately, many of you still need to navigate the web of two very complex systems--taxes and student financial aid. Whoever thought saving for college could get so complicated?

Did you set up a custodial account to save for college expenses when your child was young? Have you ever wondered if it made sense, or was even possible, to move those assets into 529 plan? Well, it is possible, and it may make sense for you to make the effort, depending on your situation.

First, some background on Section 529 plans and custodial (UGMA/UTMA) accounts.

Section 529 plans, such as the Idaho College Savings Program (IDeal) are today's preferred education savings vehicle. These plans, which started becoming available in the late 90's, enable parents (and grandparents or other interested parties) to save considerable amounts for their children's higher education expenses, with investments growing tax-deferred until they are distributed tax-free for qualified educational expenditures. They are simple to set up and there are plenty of good (and bad) plans to choose from. To top it off, many states (including Idaho) offer generous state tax incentives to utilize the home state plan.

Prior to the arrival of 529 plans, UGMA (Uniform Gift to Minors Act) and UTMA (Uniform Trust for Minors Act) custodial accounts were the most popular method for tax-favored college savings. These custodial accounts are used to hold and protect assets for a minor until they reach the age of majority. (In Idaho this is age 18 for UGMA accounts and age 21 for UTMA accounts.) When using a custodial account to save for college, the investment earnings within the account are taxed to the minor, not the parent/custodian. In 2009, youth can make up to $1,900 in unearned income (e.g. investment income in their custodial account), paying nothing on the first $950, and only 10% federal income taxes on the next $950. Above $1,900 in unearned income, the investment earnings are taxed at the parents' higher marginal tax rate--the so-called "kiddie tax". (The "kiddie tax" used to only apply kids age 14 and under. In 2006 the age was raised to 18. In 2008 it was broadened further to include students, age 19-23, who earn less than half his or her individual support.)

Although custodial accounts provide potential tax advantages to families saving for college, there are a few key disadvantages.

- Once the money is put into the custodial account, it is the child's money. The parent acts as a custodian, taking care of the assets for the benefit of the child. The parent cannot choose to move any of the assets to another child. This is unlike a 529 plan, where the parent is generally owner of the account, and can change beneficiaries of the account if they desire.

- When the child reaches the age of majority, they gain control of the account. They can choose to use the money for purposes other than college, even if their parents had intended the investments only for that purpose. This loss of control is major concern to some parents--although they should have been aware of the issue when they funded the account. (Apparently what isn't a concern when the child is a cute, little toddler, can become a major worry when they meet the teenager.)

- When determining the expected family contribution (EFC) for financial aid purposes, a custodial account is considered an asset of the student and assessed at a higher rate (20%) than parental investment accounts (including 529 plans) which are assessed at a maximum of 5.64%. (See this article at SavingforCollege.com.) As a result, the same funds held in a custodial account will have almost a four times larger impact on the EFC, potentially lowering the amount of financial aid offered to the student.

As you will see in Part 2, transferring a custodial account into 529 plan is a viable strategy to deal with this last issue (the impact on EFC), but is little help in allowing parents to regain control of the funds they placed in custodial accounts.

Investors saving for college through various state 529 plans were shocked earlier in 2008 when they suffered substantial losses in funds that were billed as conservative alternatives. Last April the state of Oregon filed suit against OppenheimerFunds in response to the poor performance of their Core Bond Fund. The fund, which was a critical fixed income component of the Oregon 529 plan's age-based portfolios, managed to lose almost 36% in 2008, compared to the Barclays Aggregate Bond Index which gained over 5% during the same period.

Yesterday, the State of Oregon announced a settlement in the lawsuit which will have Oppenheimer pay $20M to the Oregon College Savings Trust, partially compensating the 529 plan participants. Oregon had sought damages of $36M, but as they pointed out in their press release, a quick recovery of almost 60% is much better than the average recovery of about 3% of investors' losses in class action securities litigation. The $20M will be distributed among about 45,000 account holders according to their investments in the bond fund. This works out to an average of almost $450 per account.

According to the Wall Street Journal, at least five other states with similar 529 plan holdings are seeking compensation from Oppenheimer, including Illinois for $77M. Although Oppenheimer has apparently not admitted any wrongdoing, you would expect additional settlements in the future.

The moral of the story is that even conservative investments like bond funds have risks--sometimes more than we expect. Many investors were doing "all the right things", like placing their money in the most conservative age based portfolio while their children were in college, and still got burned. Fortunately for the investors in Oregon (and other states), they had the power of their attorney general and treasurer to press their case.

Another week, another newspaper article bemoaning the difficulties facing students with massive college debt--this one in the Wall Street Journal entitled "Students Borrow More than Ever for College-Heavy Debt Loads Mean Many Young People Can't Live Life They Expected". The fact that young people struggle with the burden of student loans for years hardly qualifies for news. Just listen to the Dave Ramsey Show, or watch Suze Orman, and you'll quickly pick up that a common theme among the stressed out, over-leveraged, not-so-young-anymore adults is student debt that is crushing their spirit.

As higher education has become increasingly critical for long term employability and earning potential, it has also become increasingly more expensive. This is especially true if you have your heart set on a degree from a prestigious private university. Although parents generally have 18 years of advance notice to save and get ready, many Americans are not prepared to adequately assist their children in paying for college education. For some families this is a matter of lack of sufficient resources. For others, it is due to a lack of financial planning or the will power to sacrifice and save.

Americans have turned to student loans to compensate for this shortfall in preparation. It has become more common, and more acceptable, to graduate with significant amounts of student debt--not to mention credit card debt. According to the National Postsecondary Student Aid Study, two thirds of college students utilize educational loans, and end up with an average debt of over $23,000 when they are finished. These statistics undoubtedly reflect a combination of many students with a relatively low debt load they can handle, along with a sizable subset of graduates with high levels of debt that will adversely affect their lives for many years.

In a 2008 Sallie Mae study conducted by Gallup, "How America Pays for College", the average total spending on college was over $17,200* per year. Their research showed that 23% of this total was financed by student borrowing, and another 16% was paid for by debt incurred by the parents. Thus, almost 40% of college expense was borrowed money--to be paid for by someone's future earnings. A few of the other significant takeaways from this study were:

- A very high percentage (37% of students, 46% of their parents) did not rule out prospective colleges based on tuition or other costs when making their selection decisions. (Huh? Cost is not a factor in one of the largest expenses you will ever incur? So what, if you can't really afford that expensive private college-it will be a great experience...until you have to eventually pay for it.)

- Post graduation expected income was not a factor for borrowing decisions for 70% of the students and parents. (Huh? The ability to repay a loan is not a factor in a major borrowing decision? So now you have an art history degree, a job at Starbuck's, and $60,000 of student loans you have to repay.)

- When asked about a course of action if student loans were not available, 68% of students who took out loans said they "would have found a way" to attend college without the loans. (Huh? Are you saying the long term burden of college debt was not absolutely necessary, but it just made things easier in the short term? So, if those loans weren't readily accessible you would have chosen a less expensive school, or worked a part-time job, or both?)

Enter Exhibit A--Sarah Kostecki, interviewed earlier this year in the Wall Street Journal ("Student Loans: Default Rates Are Soaring"). Miss Kostecki is 24 years old and a recent graduate of DePaul University with an international studies degree and $685/month payments on $87,000 of student debt. She laments, "It feels like I'm being punished for having gone to school." No, she is not being punished. She is just paying the price for having borrowed beyond her means to purchase something she could not really afford. What were her parents thinking when the family made the decision for Sarah to attend an expensive university that was beyond their means? Were they afraid to admit they could not afford to pay for an elite education? Did Sarah or her parents ever bother to consider what a burden this level of debt would be on a new graduate? Did they consider the alternative of less expensive public universities? And, how hard did Sarah work to help finance her own education?

Student loans, conservatively used, may be an appropriate funding strategy for some students. However, don't let the blessing of a university education become a curse due to the burden of excessive student loan obligations. Carefully assess a graduate's expected ability to handle future monthly payments, and error on the safe side. Better yet, say no to student loan debt, as Dave Ramsey would advise. Bless your children by making the sacrifice to save and assist them in paying for a good education, if possible. More importantly, help them to make responsible decisions on where to go to college, how much is to spend, and how to finance it. Education is something worth sacrificing for--but, is it worth a lifetime of slavery to excessive and unnecessary student loan debt?

*Spending at private colleges and universities averaged about $30,900/year, four year public schools about $16,600/year, and two year community colleges averaged $6,500. These totals were the composite of separate reported funding sources, and may be somewhat overstated. When asked to report total college expenditures, families reported about 15% less.

**In a 2009 update, the percentage of college funds borrowed was significantly less. This apparently was due, at least partially, to changes in methodology.

If you are an Idaho resident looking to start saving for future higher educational expenses via a 529 plan, the IDeal-Idaho College Savings Program is the logical choice. It is a relatively simple plan offering diversified Vanguard portfolios, and a reasonable asset-based annual fee of .75%. Although these fees are not excessive by 529 plan standards, IDeal is not among the lowest cost plans available. And, in the world of investing, higher costs are a drag on your earnings and should be avoided whenever possible.

The real advantage to the Idaho 529 plan, of course, is the generous state income tax deduction of up to $8,000 per year for a married couple. This opportunity to save 7.8% (Idaho's marginal income tax rate), or almost $625 on an $8,000 529 plan contribution, is a big deal. Even though you can find plans with similar, but more flexible investment options and lower than 0.25% annual fees, it is unlikely these advantages will offset the impact of the Idaho tax deduction.

If you have the good fortune, however, of having an out-of-state grandparent who is considering contributing to your Idaho children's college fund, don't assume IDeal is the best place to establish the account. First, the grandparent may be situated in another state where there is a similar tax deduction for 529 contributions (over thirty states have them), and it may make sense to use one of that state's 529 plans. Assuming there is not a tax deduction available, or the plan is unacceptable for other reasons, try looking for a lower cost plan than Idaho's IDeal. Looking at other state's plans may also make sense if you are putting away more than $8,000/year into your children's college fund. Although it may be a bit of a hassle to fund an additional account in another state, the lower fees and additional investment options may make it worth the effort.

With so many plans available (over 100) it may seem a bit daunting to shop for an alternative 529 plan. A couple of good choices to check out are listed below, but you can do your own research at www.savingforcollege.com. You might also want to look at Morningstar's reviews or their latest assessment of the best, and worst, 529 plans.

One plan to put on your list to consider is The Utah Educational Savings Plan. It was one of Morningstar's top picks, and the state offers a tax credit of up to $174/beneficiary. Like IDeal, the Utah plan is based on low cost Vanguard funds--however, it offers a wider range of portfolio options with a broader selection of underlying funds. The overall annual asset-based fees run from 0.22% to 0.35%, depending on your investment choices. You would have the opportunity to save over 0.5% per year in comparison to the Idaho plan. If you are saving a substantial amount, and assuming the same gross investment returns, saving around 0.5% in fees per year could result in thousands of dollars in additional funds available to apply to your child's education.

Another plan to investigate is The Vanguard 529 Savings Plan from Nevada. It is not as low cost as the Utah plan, but is much more flexible. You have the opportunity to select from a much larger selection of Vanguard index and actively managed funds. It offers essentially the same age-based portfolios as IDeal, but the annual fee is only 0.5% (0.25% lower).

Doing a little research on 529 plans is not just about finding the lowest cost, however. A number of plans, including Oregon's, had significant issues over the last year, so it is worth some due diligence. Investing always involves some level of risk, but you want to manage that risk the best you can. If you would like to discuss your college savings strategies and options, give Table Rock Financial Planning a call.

If you have young children (or grandchildren) and you are starting to save for anticipated higher education expenses, a 529 college-savings plan is an excellent vehicle--if you choose the plan carefully. Just for review, a 529 college savings-plan is a state-sponsored savings plan that allows you to invest significant amounts of money in a tax-favored account for the benefit of your children, grandchildren, other relatives, or friends. This money grows (or, at least that's the idea) tax-deferred until it is withdrawn tax-free to pay qualifying higher educational expenses. (Of course, if the funds are not used for qualified expenses, taxes and penalties will be due.)

If you are an Idaho resident, should you just stick with the IDeal-Idaho College Savings Program? Or, should you check out the other 100+ plans out there, since you are not required to use a plan sponsored by your home state, or the state where your child may choose to attend college? You may have heard negative stories about plans high-cost plans that have not served their investors well over the years. This has been a real problem, especially with broker-sold plans where "financial advisors" put unknowing investors in high commission, high cost plans when better, lower cost direct-purchased alternatives exist. Brokers have reportedly even put naive investors into 529 plans that pay the broker commissions, but that do not allow the investor to take advantage of valuable state tax deductions that would be available with less expensive in-state plans. Remember, we're talking about the financial services industry where it is always buyer-beware!

The bottom-line on the IDeal-Idaho College Savings Program is that while it may not be the best plan out there, it has a number of fine things to recommend it. For those of us who are Idaho residents and taxpayers it should be our first choice in 529 plans. Here are a few qualities that make IDeal a good place for your education funding:

- IDeal's underlying investments are Vanguard index funds. These low-cost funds are favorites among knowledgeable, passive investors. Index funds "buy the entire market", giving you the diversification you need, and assuring you of market returns. Unfortunately, the cost advantage of these low-cost Vanguard funds is lost to some extent by the administrative costs of the plan. These administrative fees (from the program manager, Upromise, and the state) bring the total cost of the investments up to .75% per year--which isn't bad for a 529 plan, but there are many with lower costs.

- IDeal is simple--even boring. Now that may turn some people away, but this is appropriate in a 529 plan. Many of the participants are novice investors and it is critical for the plan to make it easy for suitable asset allocation and investment decisions to be made. With IDeal, you do choose between individual mutual funds, but between very simple portfolios of index funds. Sure, your choices are limited, but this makes it impossible to create an undiversified portfolio. And, the age-based portfolio options give you three choices (conservative, moderate, and aggressive) all which transition into appropriately safer portfolios as the beneficiary nears college age. If you choose to use the six fixed asset allocation portfolios rather than the age-based ones, you can dial in the risk level that is appropriate for your particular situation--however you will still have no choice regarding the underlying funds in the portfolio.

- Investments in IDeal are eligible for an Idaho state income tax deduction. With a marginal state income tax rate of 7.8%, this means the taxpayer saves $78 for each $1,000 invested--on up to $8,000 contributed per year by a married couple ($4,000 for a single person). This is a big deal, and offsets the advantages you may find in out-of-state plans with lower costs or wider choices.

If you are an Idaho resident currently saving for your children's college through IDeal, good for you. Your money is still at risk, as it is in any investment, but you can be confident you have made a good choice in selecting your home-state plan.

If you have more than $8,000 ($4,000 if single) to invest in a 529 any one year, or if an out-of-state relative wants to contribute to a 529 plan for your children, you may want to consider some similar (but lower cost) plans in another state. More on that in Part 2.

You’re a couple of years away from sending your son or daughter to college and you’ve done everything “right”. You’ve saved diligently in your state’s 529 plan, placed your money into the conservatively managed “1 to 3 years to college” portfolio, and you then you watch in horror as your 529 account loses almost 30% in the last year. Would you be a bit upset? Apparently, a number of folks across the border in Oregon are, as are many in other states with 529 plans managed by OppenheimerFunds Inc.

The Wall Street Journal reported yesterday that the Oregon Attorney General has filed suit against OppenheimerFunds Inc. on behalf of the state treasurer to recover losses in the Oregon College Savings Plan. At issue is the abysmal performance of the Oppehheimer Core Bond Fund (OPIGX), which was a critical fixed income component in the five age-based portfolios in the Oregon plan. This intermediate bond fund lost almost 36% in 2008 and another 10% so far in 2009. Needless to say, this performance was far behind the Barclay’s Aggregate Bond Index which gained over 5% in 2008. So much for a conservative investment!

Oregon estimates that 529 plan participants lost at least $36M, and the suit alleges that Oppenheimer was negligent and breached its contractual and fiduciary duties. The state claims that the bond fund changed from a conservative fund to one investing in aggressive and risky securities including credit default swaps and other derivatives. "The Core Bond Fund was no longer a plain bond fund," the complaint says. "It had become a hedge-fund like investment fund that took extreme risks."

Oregon wasn’t the only state burned by OppenheimerFunds 529 plan management. Illinois is one of a handful of other states trying to negotiate a settlement with Oppenheimer due to the huge bond fund losses. An interesting note is that Illinois’ Bright Start Program was singled out by Morningstar in “The New Gold Standard Among 529 College Plans” in August ‘07 and still topped their 529 rankings in August ‘08. Apparently they missed the impending problem with the intermediate term bond fund selection.

I think a number of people—plan sponsors and individual investors—will be taking a closer look at their 529 plan investments, if they haven’t already.

So much is going on with the economy and the government’s response to the financial crisis it’s hard to keep up. For those of you with children in college or about to start, you’ll want to pay attention to recent changes to the various federal tax benefits for education. Although these changes may not make up for recent losses in your 529 plans or retirement accounts, they will provide significant savings for some of you.

The American Recovery and Reinvestment Act of 2009 expanded the Hope Credit program in a couple of very important ways. First, for those of you unfamiliar with the Hope Credit, it is a sizeable tax credit for qualified tuition and related college expenses which can be taken by either the parents or student—whoever claims the student as an exemption on their tax return. In 2008, the credit was for 100% of the first $1,200 of qualified expenses, and 50% of the next $1,200, for a maximum amount credit of $1,800. The student was required to be in their first two years of college and enrolled at least half-time. Just to be clear, this is per student, so if you are lucky enough to have multiple children in the first two years of college, you can claim multiple credits. Unfortunately (or fortunately, depending on how you look at it), some of you are ineligible for the credit in 2008 because of the adjusted gross income phase-outs that start at $96,000 for married filing jointly, and $48,000 for others.

Fast forward to 2009, and a good deal gets a good deal better. First, the Hope credit has been raised to $2,500 (100% of first $2,000, and 25% of the next $2,000 of qualified expenses). Second, eligibility for the credit has been extended to four years, instead of only two. And, for those of you frustrated because you missed out in 2008 because of the AGI limitation, these have been made significantly higher also. Now the AGI phase-outs don’t start until you hit $160,000 for married filing jointly and $80,000 for single filers. As this isn’t enough, the credit is now 40% ($1,000) refundable, in order to allow low income students to take advantage.

These enhancements provide a little something for almost every family with a student in college. However, the expansion of these benefits is only for education expenses in 2009 and 2010, although there are proposals to make the changes permanent.

The Hope Credit’s less attractive sister, the lifetime learning tax credit, was not similarly expanded. At least for the next couple of years, the Hope Credit will be a much better deal for all students who are enrolled at least half-time. For part-time students (less than half-time) it is still worthwhile to check out the lifetime learning credit which provides a 20% credit on up to $10,000 of qualified expenses per household.

A few other caveats regarding the Hope Credit should be noted. Qualified expenses include mandatory fees and tuition, but not room and board. You cannot use the Hope Credit and lifetime learning tax credit, or the tax deduction for tuition and fees, for the same student in the same year. You cannot use the same qualifying expenses for the Hope Credit that you use for a tax free distribution from a 529 plan.

If you’re interested in more information on education tax benefits check out http://www.finaid.org/otheraid/tax.phtml

or IRS publication 970 (although this has yet to be updated for 2009).

Next page: Disclosures