Financial Planning Blog

Value vs Growth Stocks for the Long Run (Part 2)

Value vs Growth Stocks for the Long Run (Part 2)

In Part 1 we looked at historical data showing the higher average returns of value stocks relative to growth stocks. Pondering this data one could ask: Why not invest only in value stocks, especially small and mid cap value stocks? One concern is obvious--just because value has out-performed in the past doesn't mean that it will do so in the future. Also, even though the value has out-performed growth over the long run, it certainly doesn't every year. To illustrate this fact, take a look at this "periodic table of returns" from Russell Investments--the folks who built and maintain the Russell U.S. Indexes, such as the Russell 1000 large cap index and the Russell 2000 small cap index.

These periodic tables of returns are great illustrations of why you diversify your investments across different asset classes. You'll note how the leading asset classes change from year-to-year, as do the underperforming ones. If you study this table, you'll see how large cap value has out-performed large cap growth in 10 of the 16 years (from 1994-2009). Over the same time period, small cap value also out-performed small cap growth in 10 of 16 years. But even if you are convinced that a "value" strategy is a likely key to higher returns, growth stocks often out-perform value, and sometimes by a great deal.

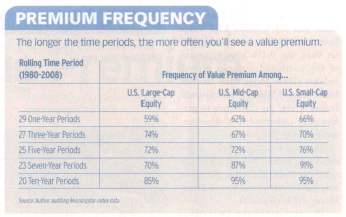

Recognizing that investors won't always wait 20 or 30 years to see the benefit to value investing, Craig Israelsen of BYU examined the relative performance of value and growth stock indexes for shorter periods of time-one, three, five, seven and ten year periods. From 1980 through 2008, large value stocks had higher returns in 59% of the one year periods. Mid cap and small cap stocks had higher returns 62% and 66% of the years. As expected, as the periods lengthened, the frequency of the value premium also increased. For rolling five year periods, value out-performed over 70% of the time. For ten year holding periods, it was 85% of the time for large stocks and an eye-opening 95% of the time for smaller stocks.

From: The Value Premium, by Craig Israelsen, Financial Planning, June 1, 2009, pages 108-110

Another finding by Israelsen was that when value out-performed growth, it was generally by a larger margin than in the periods where growth was on top. For example, in the 76% of the rolling 5-year periods examined, small cap value out-performed growth by an average of 7.56%. In the other 24% of the periods where small cap growth out-performed value, it did so by only 2.48%. The differences were not quite as impressive for large and mid cap stocks, but still very significant.

As opposed to chasing growth stocks with a great story, or even investing solely in broad market indexes like the S&P 500 and Russell 2000, this data may prompt you to consider a more significant, over-weighted exposure to value stocks. However, it is not suggested that you eliminate growth style stocks altogether. Even though a strategic overweighting to the value style appears to be a sensible approach, an underweight, balancing exposure to growth stocks will most likely smooth your ride. A less volatile portfolio not only allows you to sleep better at night, it can also help reduce "volatility drag" on your long term returns.

Next page: Disclosures