Financial Planning Blog

When mountain biking with my wife and friends, we often remind each other of a very important concept--the penalty of failure*. There is nothing quite like a big drop off the side of the trail to change the risk-reward equation when encountering a particularly technical, rocky section. Without the potential of a long, painful fall that could seriously impact our ability to enjoy future outings, we might otherwise ride the section with confidence...or at least give it a sporting attempt. It is that relatively small possibility of tumbling down a steep hillside into a rocky creek that overwhelms the depleted testosterone levels of the 50-somethings I choose to ride with. Humility is our friend.

I used to joke that helmets messed up my hair. That was before the brain surgeons shaved my head and then closed up the suture with stainless steel staples. -- Comment on blog discussing the bicycle helmet debate

Considering both the penalty of failure and the probability of failure is important in personal financial planning. If they are severe enough, the consequences of our potential failures are often more important than the probability of our success or failure. This is why we buy fire insurance for our homes, and life insurance while we are young, healthy and raising children. Although we know we will likely never cash in on the policies, the downside is just too much to risk.

Retirement planning is a key area where we should be concerned not only with the probability, but the penalty of failure. We don't just want to know what will happen if things go well, but how will we fare if things go bad. Your financial projections may look great, assuming you get reasonable returns on a consistent basis, and you don't live much beyond your life expectancy. However, what happens if market returns are significantly lower for an extended period of time, or you simply have the back luck of encountering a bear market right when you start to take large withdrawals from your retirement accounts? What happens if you (or your spouse, or both) happen to live long beyond your average life expectancy--say to age 95 or 100? In addition, what are the consequences if one of you (or both) needs expensive long term care services?

We can't eliminate all of the risk in our lives or financial plans. However, we can often mitigate the consequences of failure or bad luck. We can lessen the potential penalty of failure by implementing different strategies to secure a healthy, guaranteed minimum floor of retirement income that will last for a lifetime. For example:

- Maximize your Social Security benefits, which will give you (and your spouse) inflation adjusted benefits for across both your lifetimes.

- Consider forgoing the lump sum benefit, and take your employer pension (if you are fortunate enough to have one) as a monthly annuity with survivor benefits.

- Use some of your retirement savings to purchase low cost immediate annuities to create your own lifetime income stream--a do-it-yourself pension. Although it adds to the cost, consider buying these with inflation protection.

Even if you think the probability of needing expensive long term care is low, consider the penalty of failure. Will you have sufficient income and assets to pay for care, even if the markets don't cooperate? If the penalty of failure is simply a smaller inheritance for your children, this is an acceptable risk for most of us. However, if the penalty of failure is leaving your spouse financially insecure or destitute, than the risk is simply unacceptable. If the penalty of failure is relying on government assistance (Medicaid) you should strive to avoid it by proper planning. Although we may not eliminate this risk, we can mitigate the consequences by purchasing a reasonable level of long term care insurance, or by dedicating sufficient assets to pay for any necessary care.

If you study enough financial planning literature, you are bound to come across references to Pascal's Wager. Blaise Pascal was 17th century French philosopher, who reasoned that although it was impossible to prove the existence of God, it was a smart wager to believe in Him when a person considers the consequences of the decision. When you weigh the costs, benefits, risks and rewards, it is certainly a much better bet to put faith in God than to join with the non-believers. Although I suspect that financial writers have taken considerable license in adapting Pascal's reasoning to modern day risk management, that isn't critical for our purposes. The key point is that in making decisions, avoiding unacceptable outcomes (e.g. eternity in hell or moving in with your in-laws) should be a top priority.

When making our personal plans, we would all be wise to consider the sage advice of respected author, investment advisor, and former Oregon neurologist William Bernstein: "Always consider Pascal's Wager: What happens to my portfolio--and my future--if my assumptions are wrong?" You can count on him for a consistent reminder that, "The name of the game with retirement planning is not to get rich. Instead, the goal is to not be poor."

You can also bet he has a strong opinion on wearing bike helmets.

----------------------------------------------

*Miles lived to ride another day. See him after the crash.

As these recent NPR segments discuss, baby boomers are becoming increasingly aware of the financial risks that long term care poses, both for their parents and for themselves. As they assist their parents in dealing with the emotional, logistical, and financial burdens of long term care, boomers cannot avoid pondering how they will personally cope with these challenges in the future. When you consider the probability of requiring some type of long term care, and its increasingly high cost, it is easy to get overwhelmed. However, instead of just worrying about long term care, do something constructive--make a plan.

Let our advance worrying become advance thinking and planning--Winston Churchill

A critical first step of your planning is to understand what coverage you may already have for long term care expenses. Although many people are mistaken (or deluded) that Medicare will cover most of their nursing or home care costs, this isn't really the case. Medicare will cover 100% of the first 20 days in a nursing home, along with an additional 80 days subject to a significant copayment. This is has proven to be substantial benefit for a great many people, but it isn't a long term long term care financing solution. Medicare's coverage of home care is more open-ended, but has definite restrictions. For example, the patient must have a need for "skilled care", not simply assistance with the activities of daily living. Your private health insurance and Medigap supplemental policies may also provide limited coverage in the early days, but also are not long term solutions.

That's it--after the first few months of care you need a plan for paying for any potential long term care needs that may arise. If you are single, planning is fairly straight forward, although not necessarily easy. Ignoring for a moment the possibility of families providing care for one another (i.e. the old fashioned way), the financial resources most people can call upon are limited to the following:

- Monthly income from Social Security, pensions, and lifetime income annuities

- Investment assets, including your home equity

- Veterans long term care benefits

- Private long term care insurance

Look closely at your available resources, and consider whether they will be sufficient to provide adequate care for you, should you need it at age 70, 80, or even 90. For example, your retirement income may not be able to cover the entire cost of assisted living or nursing home care, but it will cover a percentage. Next, you may want to set aside a portion of your investment assets specifically to cover any potential long term care--promising not to spend it on vacations, new cars, or whatever. Alternatively, a reasonable plan may be to sell your (presumably paid off) house, using the equity to pay for your care. Finally, you should at least consider the purchase of long term care insurance, allowing you to transfer the risk of future LTC needs to an insurance company, at the cost of a predictable annual premium.

Planning for couples, however, is more complicated. Although couples have the distinct advantage of providing care for each other in many situations, they face the added risk of a surviving spouse being left financially insecure after an expensive long term care episode. When outside caregivers are eventually required, whether at home or in an assisted living or skilled nursing facility, a couple's financial assets can become quickly depleted. Whereas a single individual can plan to use the entirety of their retirement income and financial assets to pay long term care, a couple cannot afford to do this. The person not receiving care still has income needs, still has housing needs, and will still need to draw upon the financial assets for what could be many years into the future.

We are naturally concerned about our spouse's welfare should we predecease them. Besides leaving a spouse emotionally and physically exhausted, the possibility of leaving our spouse financially destitute after paying for long term care is a risk none of us should willingly take. For this reason, it is all the more critical for couples to either set aside dedicated financial assets for long term care contingencies (i.e. self insure), or to purchase sufficient long term care insurance.

Besides relying on your retirement income, financial assets, and insurance to deal with long term care contingencies, there are at least two other potential options--family members and government assistance. If there are family members willing and able to care for you as you require, this is may be a viable solution. Caring for an aged parent is an undertaking deserving of much honor and respect. However, if you are counting on children to step up to this task, please discuss this possibility with them long beforehand. Your children need to be aware, and possibly plan for this potential. Also, consider the possibility that circumstances (e.g. divorce, health, finances, etc) may preclude the option of your children providing care.

Finally, there is a backstop of government assistance for long term care. Medicaid now pays for over 40% the nation's nursing home expenditures, and over 30% of home care. With federal and state budgets stretched to their limits, Medicaid simply cannot continue to be the long term care financing solution for the middle class. If you care about keeping your taxes low, and are disturbed about government spending and debt, Medicaid should not be your long term care plan. And, if you are concerned about the best quality care you or your loved ones, Medicaid should not be your preferred long term financing solution.

Instead of worrying about the future and possible long term care, do something constructive--make a plan. Discuss the alternatives with your spouse and other family. If you need assistance, consider consulting a fee-only financial planner--someone who will objectively assist you to evaluate your options, not sell you a product. Facing these issues may not be pleasant and may take some effort, but hopefully this preparation will result in less unproductive worrying, and more peace of mind.

We may be required to buy automobile insurance, but we are not necessarily required to understand it. If you are like most people, you may have understood your coverage when you last shopped for insurance, but you would struggle if forced to explain it today.

Below is very quick summary of your automobile insurance coverage, with a few comments. However, you would be wise to skip it and simply view this short instructional video by financial planner and educator, Tim Maurer--Before You Hit the Deer...in 90 Seconds or Less. Although he doesn't quite cover his topic in 90 seconds, you get to see a clip of the deer destroying David Spade's car in Tommy Boy. (I never saw the whole move, but I certainly remember my teenage sons enjoying this scene.)

Part A--Liability Coverage

Your automobile liability coverage insures you against costs that you become legally responsible for because of injuries or property damage you caused to another person due to an automobile accident. Most policies are written on a split limit basis, with different limits for bodily injury and property damage. For example, you are probably familiar with limits being stated like this--$250,000/$500,000/100,000. This means:

- Bodily injury coverage is $250,000 per person.

- The maximum bodily injury coverage per accident is $500,000.

- The maximum property damage liability per accident is $100,000.

As Tim Maurer suggests in the video, $250K/$500K/$100K are reasonable limits. If your coverage is for less, discuss with your insurance professional whether they should be increased.

Who exactly is covered by this liability insurance? In general, it is you and your covered relatives while using any car. Also, it covers any person using your car, with your explicit permission.

Part B-Medical Payments Coverage

Sometimes referred to as "med pay", this covers reasonable medical expenses for the insured person. Whereas the liability insurance in Part A covers the other person (the one you accidently hit with your car), this coverage is for you (the insured), and the limits are significantly less (e.g. $10,000 per person). Generally speaking, this covers you, your covered relatives, and any other person in your covered automobile. It also covers you and your covered relatives if struck as a pedestrian by a motor vehicle licensed on public roads.

Medical payments coverage not only pays for resulting medical and dental expenses within three years of the accident, but also funeral expenses. Although this coverage may help pay your medical expenses in the event of an automobile accident, it should not be seen as substitute for broad based medical insurance.

Part C-Uninsured and Underinsured Motorists Coverage

In the event you are in an accident with an uninsured, or underinsured motorist, this coverage would kick in. Uninsured motorist coverage would also protect you in the event of a hit-and-run driver. Unfortunately, there are plenty of uninsured drivers out there--the Insurance Research Council estimates one out of every six. With these odds, it is certainly prudent to have this protection, with limits similar to your own liability coverage. In Idaho, insurers are required to include uninsured and underinsured coverage standard with automobile policies, however consumers have the option to reject it in writing. (Not recommended.)

Part D-Coverage for Damage to Your Auto

This includes collision coverage, which insures you for damage to your car in a collision--i.e. when there is impact or upset involved. It also includes comprehensive coverage which covers damage from anything other than collision, including fire, explosions, hail or other falling objects, and animal damage (including collisions with animals).

With collision and comprehensive coverage the insurer pays for the loss of your property, less any deductible. This is where an individual needs to be a savvy consumer, trading off the cost of the coverage versus the potential risk of loss. It may not be necessary to pay for coverage against risks you are financially capable of self insuring for. For many it is a wise decision to accept higher deductibles, or even drop collision or comprehensive coverage as the car gets older.

For those of us who drive Highway 21 often, Tim Maurer's explanation of this coverage is extremely helpful:

- If you are driving down the highway and hit a deer that jumps in your way--that is covered by comprehensive. (Almost like a tree falls over and hits you.)

- If you swerve to miss the deer and hit a tree--that is covered by collision.

- If you hit a deer, put it in the back seat, and the deer subsequently causes damage after coming back to life--ask your agent.

If you want to learn more about your auto insurance, download this consumer's guide from the National Association of Insurance Commissioners. For extra credit, you might even try reading your own policy--who knows what you'll learn.

Planning for retirement is difficult. If you just knew how long you are going to live, what inflation and tax rates are going to be, and how the markets are going to perform it would reduce the challenge tremendously. However, among the other unknowns is the risk that you or your spouse will require significant long term care (LTC) expenditures that could potentially overwhelm your savings. In Part 1 of this series this risk was described--and it's not for the faint of heart. For example:

- The 65 year old American male has >33% chance of requiring care in a nursing home. For the 65 year old female the probability is >50% .

- There is a >50% probability the nursing home stay will be longer than one year.

- In 2009 the average cost of nursing home care in the U.S. (and Boise, specifically) was about $200 per day, or >$70K per year.

Many people simply ignore these risks when doing financial planning for retirement. (Actually, many just fail to do financial planning--period.) They blow off these real risks with casual or foolish remarks like, "Just shoot me if it comes to that." Or, "I'll just move in with the kids." Or, my favorite, "Doesn't Medicare or Medicaid pay for that?" Unfortunately, these attitudes demonstrate a lack of responsibility and concern for your loved ones. Please take time to consider:

- Your spouse or children are not going to take you out back and shoot you to prevent you from going into a nursing home. They are going to be very concerned about you receiving the best, most compassionate care possible, at home or, if necessary, in a quality facility. Having the financial resources and/or long term care insurance (LTCI) will give them the ability to do this. If you don't plan and have these resources available when needed, you put your loved ones at tremendous financial risk. The risk isn't yours, it is theirs--and it really isn't loving or fair to put them at risk unnecessarily.

- You may plan on moving in with your adult children for long term care, if necessary. This is the way things used to be done, and may be still be a reasonable plan. However, have you discussed this with your children, and are they "bought in" to this plan? Remember that your adult children may be struggling to provide for their own families, fund your grandchildren's education, and save for their own retirement. Don't underestimate the financial and emotional burden you may be to your children, not to mention the commitment of their time and energy. If they are ready and willing, great. Just be aware, there is a risk their situation may change for the worse (think job loss, cancer, divorce, etc) in the intervening years, and they may not be in a position to care for you.

- Relying on the federal and state governments to take care of you is not a solid plan. Medicare only covers part of the first 100 days in a nursing home. Maybe the government provided benefits for LTC will be increased, due to the demand of aging baby-boomers who have failed to plan for their own care. Don't count on it, however. Who is going to pay for this?

- In many ways, Medicaid has become the default LTC insurance for the middle class. However, having private LTCI or your own financial resources may be critical in you obtaining the type of high quality care you expect. Medicaid is unlikely to provide the level of service you want. Besides, call it what you want--Medicaid is welfare. Do you think it is fair to have your neighbors and fellow citizens pay for your LTC, if with proper planning, you could have done so yourself? Are you willing to pay higher taxes today to provide for others who could have paid for their own care?

Many people may be convinced of the risk that future LTC requirements represent, however they can't bring themselves to purchase LTCI. Since less than 10% of adults have any sort of LTCI, most have either ignored the issue, or have said no to LTCI for at least the present time. Although passing on LTCI may not be the best long term decision for them and their family, it is totally understandable. We hate long term care insurance because:

- The LTC risk is not perceived to be a present risk. When we buy car, homeowners or health insurance, we are insuring against the present (i.e. this year's) danger of an accident, fire, theft, illness, etc. These dangers are perceived as imminent, whereas the risk of needing LTC is predominately one that is far in the future. Even when we buy term life insurance, we perceive value in the protection against an untimely death today, tomorrow, or for the length of the term.

- Since the main risk of LTC is far in the future, we don't like the idea of paying for it today, with the obligation of continuing to pay for virtually the rest of our lives. The arguments for buying LTCI earlier rather than later--it's cheaper and there is less underwriting risk--aren't compelling enough for us to purchase now. After all, wouldn't the wisest financial decision be to put off buying LTCI until right before you need it? That is a great plan if you can pull it off. Just remember, it may be impossible for you to get insured if you wait too long--just like it is too late to buy fire insurance when you hear the sirens and smell the smoke.

- Unlike automobile and homeowners insurance, we are not required to purchase LTCI--although in some respects, maybe we should be. When we don't buy LTCI we may be passing off our financial risk to our spouse, children, or the government (i.e. your friends and neighbors) without their consent. Many expect Medicaid to step in and cover our LTC costs, but would never expect the government to rebuild the house or fix the car of the uninsured.

- If we don't use the LTCI, we generally lose all the premiums. Of course, this is the nature of insurance. If we don't get in a car wreck, we lose all those premiums. If we don't have a fire, we lose all those premiums. If we don't die, we lose those life insurance premiums. However, this seems to really bother people with LTCI. (For what it's worth, I would much rather pay years of LTCI premiums and never have to use the insurance, than to save all those premiums and spend the last years of my life in a substandard nursing home on Medicaid.)

- LTCI is complicated. The purchase decision is made even more harder by the difficulty of anticipating your needs far into the future.

- We don't like to think about getting old or needing LTC in a nursing home, any more than we like thinking about an untimely death. However, most of us (or at least those reading financial planning blogs) have been responsible and have purchased life insurance (and maybe disability insurance) to protect our family from such risks. Evidently, it is more acceptable to shirk the responsibility for planning for LTC.

- There is no joy in LTCI. Unless we have a surplus of funds in retirement, the commitment to paying LTCI premiums for the rest of our lives generally means having to give up something we like better. Maybe it's fewer vacations or fewer dinners out. Maybe it is giving less to the grandkids or being on a stricter budget. Maybe it is a smaller inheritance for the kids. However, when compared to consciously self-insuring (i.e. setting aside funds for LTC, in case you need them), purchasing LTCI may actually buy you some freedom. If you know that the potential for LTC has been dealt with, you may be able to spend the rest of your retirement nest egg more freely.

Maybe you are convinced that planning for your own long term care is the right thing to do. Purchasing LTCI isn't right for everyone, but certainly more of us should be buying LTCI than are currently. And, a thorough consideration and thoughtful discussion of LTC issues with your family is certainly an important part of all of our financial planning. If you are approaching retirement, don't avoid it any longer.

Whether or not to purchase a long term care insurance (LTCI) policy is one of the most important and difficult retirement planning decisions. In Part 1, the costs and risks of potentially requiring long term cares services were laid out. These risks should serve as motivation to at least consider long term care insurance. However, as you will see from the following brief summary, LTCI policies are relatively complex with many choices. It is difficult enough to decide on the options for your medical insurance policy that will be in force for only the next year or so. Making the many trade-offs necessary in selecting a LTCI policy that will likely be used far in the future, if at all, is somewhat overwhelming.

Here is a quick summary of key LTCI provisions and features. This isn't all there is to know, or even all you need to know. It's a start however. Links for additional information are at the end of the article.

Benefits

- The daily benefit is generally the maximum amount the insurance company will pay for nursing home care per day. (The maximum benefits for home or other care may be lower.) Daily benefits of $100-250 per day are common. This may also be specified by the week or month. It is stated in today's dollars, but will grow with inflation if you purchase inflation protection.

- The benefit period is how long the benefits will be paid. It is usually from 1 to 5 years, but can be unlimited.

- The lifetime benefit is the total amount of insurance, and is calculated by multiplying the benefit period times the daily benefit. For example, a $100 daily benefit for 5 years will give you a total lifetime pool of benefits of $182,500 (100x365x5). A $250 daily benefit for 2 years will give you the same lifetime benefit total of $182,500 (250x365x2).

- Which is better, the "long-skinny" policy ($100x5 years) or the "short-fat" policy ($250x2 years)? If the cost is close, the short-fat policy is preferable. This is because if you don't use the entire daily benefit, the short-fat policy will stretch out and become a longer policy. For example, if you only use $100 of the $250 per day maximum, the policy will last five years, just like the long-skinny policy. However, if you have a long-skinny policy with a $100 daily limit, but actual daily expenses of $250, you still will only be reimbursed $100. You may have significant out-of-pocket expenses for a considerable time, and still die without exhausting your full insurance benefit.

- The most common method for benefits to be paid is under the expense incurred method. Like most medical insurance plans, it pays the lesser of the amount billed or the policy limit. Some policies use the indemnity method that pays a set dollar amount per day once you start receiving services. This is simpler, and generally maximized benefits paid earlier.

Benefit Triggers

- This term refers to what must happen for the insurance company to start paying. Benefit triggers usually refer to the inability to do two or more activities of daily living (ADLs) without assistance, or cognitive impairment. (ADls include bathing, eating, dressing, toileting, continence, and transferring.)

- The concept of benefit triggers may sound simple enough, but check the policy description carefully. For example, some policies state "hands-on" assistance be necessary before eligibility for benefits, while others are more liberal and require only "standby" supervision.

Elimination Period

- Think of the elimination (or waiting) period as a type of deductible. It is the period of time you must wait after hitting the trigger before benefits start. Insurance companies will measure this period differently-some will demand continuous days of care, others will allow days of intermittent care to be accumulated. A longer elimination period may lower your premiums significantly.

Inflation Protection

- Most advisors consider inflation protection a must for LTC policies. What sounds like a healthy benefit today will likely be totally unsatisfactory in 15+ years. Consider that the $200/day average nursing care room today will be about $400/day in 20 years, assuming only 3.5% inflation.

- Inflation riders may be either simple or compound, and generally assume a 5% inflation rate, instead of following some index such as the CPI. Although a simple inflation adjustment may be adequate, don't under estimate how big a difference it can make. A $200 daily benefit increased by 5%/year using a simple adjustment would pay $400 after 20 years. The same $200 daily benefit adjusted under a compound inflation rider would pay $530 after 20 years-almost a third more.

Services Covered

- You want to make sure the policy covers a wide range of services you may require in the future. Is home care covered, or only services provided in a nursing home or other facility? Is assisted living and other services like adult day care, respite care, hospice and homemaker services covered? Are there licensing requirements for the service providers?

Guaranteed Renewable

- Most policies are "guaranteed renewable", meaning that the insurance company cannot refuse to renew coverage for any reason other than non-payment. Your rates can still go up, individuals cannot be singled out-the rate increase must be for an entire class of insured (e.g. all policies in Idaho).

Payment Options and Non-Forfeiture Provisions

- Most policies are paid for by "continuous premium", meaning you pay premiums until benefits are triggered. Another method is the "limited payment option" where you pay premiums for a set number of years-e.g. 10 or 20 years, or even a single payment. After the last payment the policy cannot be cancelled. These policies are obviously more expensive to start, but the fixed payment is preferable to some.

- Many people are concerned about the potential of paying significant premiums, only to lose the policy in the future if they cannot continue to make the payments. To mitigate this risk, most policies include some sort of non-forfeiture provision which will allow you to keep some level of benefits even if you stop making payments. These non-forfeiture provisions are structured in different ways, so you'll want to understand them and how they impact the cost of the policy.

If you are interested in more information on long term care and long term care insurance, go to the National Clearinghouse for Long-Term Care Information sponsored by the U.S. Department of Health and Human Services. You can also download a useful planning guide. There are also a good summary of tax incentives for purchasing long term care insurance and paying for long term care at the American Association for Long-Term Care Insurance.

In Part 3 we'll explore why planning for the financing of long term care is such a difficult decision.

One of the most important decisions a person (or couple) needs to make in regards to retirement planning is whether to buy long term care insurance (LTCI). It is a difficult decision to analyze and a subject most would prefer to ignore. In spite of the difficulty or unpleasantness, the risks of substantial long term care costs are real and need to be thoughtfully considered. The LTCI decision not only impacts the quality of care you may receive in the future, but likely has significant financial implications for others in your family.

In Part 1, we will define what long term care (LTC) is and examine the risks associated with potentially requiring it. Part 2 will be a quick summary of things you need to know about long term care insurance. Part 3 will be a discussion of the long term care financing decision.

What is long term care?

Unlike traditional medical care, where the goal is the cure or correction of a condition, long term care is focused on helping individuals live with chronic conditions--physical ailments, disabilities, or cognitive impairment. Long term care provides assistance to meet basic living needs for an extended period of time. These supportive services are often defined as either skilled care or personal care.

- Skilled care is provided by medical personnel (e.g. registered nurses) and must be ordered by a physician and follow a plan. Skilled care is often provided in a nursing home, where it is available 24 hours a day, but can also be received as in-home care.

- Personal care, or custodial care, is focused on helping with activities of daily living (i.e. bathing, eating, dressing, toileting, continence, and transferring). It is delivered in a variety of settings by less skilled providers.

What is the risk?

Long term care is an important risk to be concerned with because of the relatively high probability of an individual eventually needing care, and the potentially high cost of that care. Studies(1,2) show that if you are an American male at age 65, you have about a 33% chance of receiving care in a nursing home. The probability of requiring nursing home care is >50% for American women. For those who do enter a nursing home, there is a >50% chance of staying for longer than 1 year, and a 15-25% chance of staying for 2 years or longer. The average age for entering a nursing home is about 84 years.

Long term care is delivered in more than just nursing homes, so these statistics understate the risk. When you consider the other LTC options (e.g. assisted living, group home care, home care, adult day care, respite care, etc.) your chances of needing some type of care is at about 70%(2). This is, of course, somewhat dependent upon your family support system.

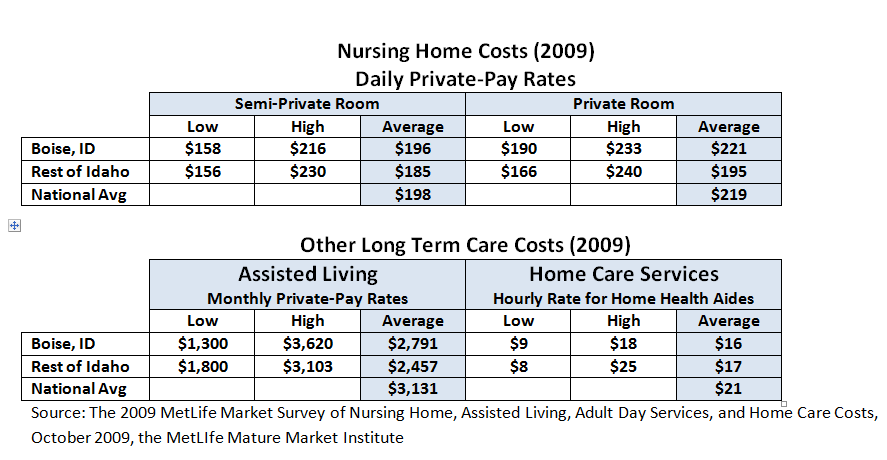

The cost of long term care can vary widely across different localities, and across facilities within a locality. MetLife does an annual survey of long term care costs across the country, and below are the costs they observed in Boise and the rest of Idaho. You'll note that nursing home costs in Boise track the national average, but assisted living and home care are somewhat lower.

In case you didn't do the math, the average cost of nursing home care in Boise for one year is over $70K for a semi private room, and over $80K for a private room. Assisted living averages over $33K per year. These are pretty scary numbers, especially if you aren't financially prepared. When you consider the possibility of these costs rising faster than the overall inflation rate the numbers are daunting. In 25 years, that $70K per year for a semi private room in a nursing home becomes over $145K with 3% inflation, and over $235K at 5% inflation.

These numbers should get your attention. And, in case you were counting on Medicare to cover these costs, think again. Medicare covers only pays for part of the first 100 days in a nursing home, although it offers more open-ended coverage of home care for those with skilled care needs. Your private health care insurance coverage for LTC will also be limited-you need LTCI for private extended care coverage. Without LTCI, you will need to cover the cost from your own income or assets. If you cannot pay for your care, you will need to rely on your family or Medicaid to cover the costs. Unfortunately, from a taxpayer's perspective, Medicaid has become the default LTC insurance provider for the lower and middle classes--it accounts for close to 50% of total LTC expenditures. (More on this later.)

In Part 2 we will examine some of the key features of long term care insurance. In the meantime, you might want to go the National Association of Insurance Commissioners and request a free Shopper's Guide to Long Term Care Insurance.

---------------------------------------------------------------

1) Stillman and Lubitz, "Medical Care" (2002)

2) Stone, "Long-Term Care for the Elderly with Disabilities: Current Policy, Emerging Trends, and Implications for the Twenty-First Century" (Milbank Memorial Fund--2000)

In Part 1, the first three risk management topics mentioned in the Morningstar article, "Are You Adequately Insured Against Risk?" are discussed. The remaining three risk topics are covered here.

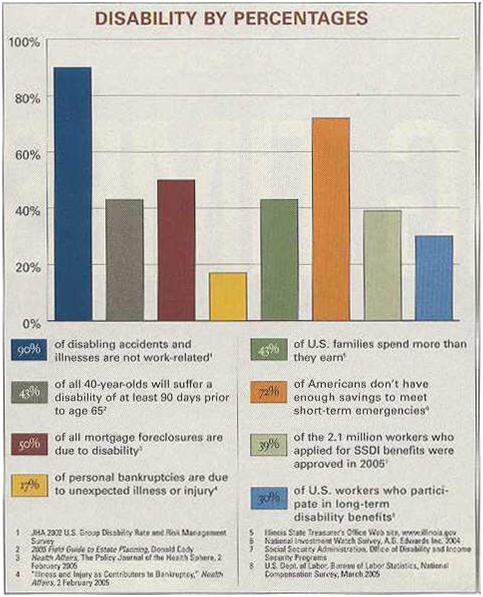

Disability income insurance--You face a much higher risk of being unable to work because of a disability, at least temporarily, then from premature death. Unfortunately, many Americans do not have adequate insurance to replace a lost income in case of a disability. Many believe that Social Security will cover them in the event of a disability, but this may prove to be an erroneous assumption since Social Security benefits will not necessarily be sufficient and are very difficult to qualify for (believe it or not).

Disability insurance is complicated, and although necessary, it can be expensive. This is an area that a competent insurance professional can really help out. For some good background on disability insurance policies, here (and here) are a couple of Investopedia articles for some background on the subject.

If you are fortunate enough to have disability income insurance from your employer, consider two things. First, if your employer is paying your premium, your benefits will be taxed. If you pay for the coverage yourself with after-tax dollars, your benefits will be tax free. Second, after you figure your after-tax benefits, is this coverage truly adequate to protect your family? You may want to purchase additional DI insurance above your employer provided coverage.

For some interesting disability statistics, check out this chart from the Zander Insurance website.

Umbrella liability policy--These personal liability policies are secondary insurance that sits on top of your auto and homeowner's policies, providing higher levels of liability protection in case you are sued. If you have significant assets to protect you should look into adding an umbrella policy. Although it bothers me to buy too much insurance, in this litigious society the additional peace of mind may be worth the relatively small additional cost. You should consider the potential risks your family faces--whether it is your swimming pool, teenagers who are driving, big dogs, rental property--and think through whether you need this additional insurance. Surprisingly, I find that insurance salesmen don't always push this extra coverage. For more on this topic check out these articles from MSN Money, the NY Times, and Investopedia.

Long term care insurance--The risk of needing expensive long term care late in life is substantial. Like it or not, studies show that for those who live to age 65, you have a 40-50% chance of receiving care in a nursing home. And, this care is expensive--the average cost of a private room in Boise was over $70K per year in 2007. Of course, long term care encompasses more than just nursing homes, but also home care, assisted living, and potentially other care. Whether you self insure, or purchase long term care insurance, the potential for long term care expense is a risk we need to plan for, not ignore. These are tough decisions, and need to be considered in your retirement planning. Again, this is an area that a competent financial planner can add significant value.

A good place to start for long term care information is the National Clearinghouse for Long Term Care Information.

A recent article by Morningstar director of personal finance, Christine Benz, highlights the importance of managing our financial risks, whether these risks are found in our investment portfolios or in many other areas of our lives. Benz does not claim to be exhaustive in this discussion, but highlights six key areas for consideration. Her article is worth reading, and the first three areas she covers are listed below with additional comments.

Having an adequate emergency fund--Although this is an obvious place to start, it is sadly overlooked by so many individuals and families. In our rush to meet other objectives, generally improving our current lifestyle, but sometimes it is aggressively investing for the future, we fail to assure our basic financial security. Whether the emergency is a job loss, unanticipated medical expenses, or major repairs to your home or car, you should make it a top priority to be prepared. Although the standard advice is something like three to six months living expenses, the right amount is a function of your personal risks and desire for security. This is a worthwhile topic to discuss with your financial planner--especially a fee-only planner who doesn't have a vested interest in allocating your savings into investments that pays the advisor a sales commission. For some useful discussion of the topic check out this Kiplinger's article, or a series of articles at About.com.

Identity theft--This risk has become top-of-mind for many over the last several years, and if you are interested in learning more, including ways to make yourself safer, check out the Federal Trade Commission's Identity Theft site. Benz does not discuss the topic of identity theft insurance, but it is something that Dave Ramsey recommends. Although the specific policy that Dave recommends appears to have features that make it worthy of consideration, many personal finance columnists and consumer advocates do not think these policies are worth the cost--take a look here, here, here, and here.

Having adequate life insurance--This is the first of four insurance policies that Benz discusses. If you have a family depending upon your income (or possibly your services as a homemaker and caregiver) you should almost certainly have adequate life insurance coverage. Benz states, "Life-insurance agents may disagree with me, but term insurance is often the most effective (and certainly the most cost-effective) solution for many individuals." I would state this a bit more strongly: Buy term life, not whole life (or cash value, permanent, universal or whatever it's called) insurance. Again, don't let an insurance agent talk you into a whole life policy without first discussing the issue with a fee-only financial planner who won't be making a sales commission on your purchase. At the same time, have the planner advise you on how much insurance makes sense for you and your family.

Go to Zander Insurance Group for a decent discussion of the term vs whole life issue.

In Part 2, the next three topics mentioned in the Morningstar article (disability income insurance, umbrella liability coverage, and long term care insurance) will be discussed.

After a long period of trending downward, term life insurance rates have started to head back up. According to a recent article in the Wall Street Journal, insurers have been increasing premiums an average of 5-15% since the beginning of 2009. The reason given for the increases are lower returns on investment (sound familiar?) and higher costs in maintaining required cash reserves.

This isn't good news if you are currently in the market for term life coverage. However, these modest increases should not keep anyone from obtaining the coverage they need for their family. It may be incentive, however, to hurry up and get shopping. Apparently, not all companies have raised their rates, yet.

Is this just a temporary setback, or the start of a new trend? Who knows--but even with these increases term life insurance (not whole life, permanent life, universal life or other high priced, high commission life insurance products) is a good deal. Just look at how term life insurance rates have come down over the last ten years and you'll feel better, even if you end up paying a bit more than you would have in 2008.

Next page: Disclosures