In the previous post, the key rules regarding Social Security spousal benefits were introduced. Although most people are aware that a married worker’s spouse can receive a retirement benefit off the worker’s record, few appreciate exactly how much this influences the replacement income Social Security provides a family. Some examples will illustrate key points about how marriage, the distribution of income between spouses, and the availability of spousal benefits impact the amount of benefits received from the Social Security system.

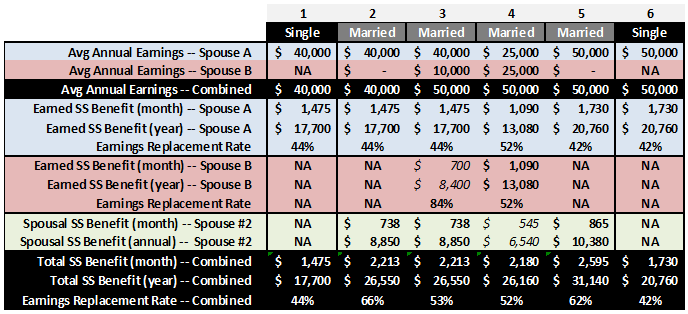

Below are six different situations with workers making an “average” income of $40,000 to $50,000 per year. In two of the examples the workers are unmarried, with the other four comprised of married couples. In two of the married couples, one spouse does not work. In the other two married couples, both spouses have earnings covered by Social Security. (It is assumed all are retiring in 2012 at their full retirement age of 66. None of the individuals have been reading financial planning blogs suggesting they wait until 70.)

- Compare the single individual and the married couple, both making $40K/year (#1 and #2). Even though earnings and taxes paid into the Social Security system are the same, the married couple stands to receive a considerable amount more from the system. Due to the availability of the spousal benefit (equal to 50% of the worker’s primary insurance amount), the married couple will receive benefits replacing 66% of their pre-retirement income, compared to the single person replacing only 44%. Is this fair? I suppose it depends on whether you are the single person, or part of the married couple.This is a prime example of how Social Security is family oriented.

- Now compare married couple #2 with average earnings of $40K and married couple #3 with average earnings of $50K per year. Notice that spouse B of couple #3 contributed $10K/year of their earnings, and earned their own personal benefit of $700/month. However, spouse B’s earned retirement benefit is lower than the $738/month spousal benefit they are eligible for. The Social Security Administration (SSA) will supplement spouse B’s earned benefit to bring it up to the $738 spousal benefit. Note that the combined benefits of couples #2 and #3 are equal, even though couple #3 made 25% more money, and presumably paid 25% more into the system. The earnings replacement rate of the lower earning couple #2 is 66%, but drops to only 53% for couple #3. Unfortunately, that part time job for couple #3 didn’t contribute as much to their retirement as they had anticipated. Hopefully, they saved a good part of spouse B’s earnings.

- Similar to couple #3, couples #4 and #5 also earned $50K, but did so in different ways. In couple #5, only spouse A worked and earned a benefit. In couple #4, both spouses contributed equally to the family finances, both earning $25K/year. Both earn an equal benefit from Social Security, which is higher than the spousal benefit they would be eligible for off the other spouse’s record. Note that couple #4, where both spouses worked, has an earnings replacement rate of 52%–slightly lower than couple #3. Couple #5, where only one spouse worked, has a remarkably higher combined earnings replacement rate of 62%–about $400/month more than couples #3 and #4 where both spouses worked. How earnings are split between spouses makes a surprising difference. For these average earning couples, having the earnings concentrated with one spouse leads to higher earnings replacement rates. However, having earnings concentrated with one spouse does not necessarily lead to higher benefits as incomes rise, as you’ll see in Part 2.

- Finally, compare the two single individuals (#1 and #6). As expected, the one making $50K/year has earned a higher retirement benefit than the one making $40K/year. However, notice that the earnings replacement rate is a bit lower for the higher earning worker as compared to the lower earning worker (42% versus 44%). Even though Social Security retirement benefits increase with higher average lifetime earnings, the amount of pre-retirement income that is replaced by Social Security significantly declines. As you’ll see in Part 2, the replacement rate for a single worker averaging $125K/year drops to under 25%. This is just one way that Social Security benefits are already “means tested”–where higher earning people pay more and/or receive less from the system. Most will agree this is somewhat appropriate, but it is important to consider how much “means testing” is currently in the system before calling for more.

These examples give you an idea of how different factors determine the amount of replacement income people can expect from Social Security. Obviously, it makes a big difference for an individual or couple whether their Social Security benefits will replace 20% or 60% of their pre-retirement income. After all, they need a plan to cover the rest or else face a severe drop in lifestyle in retirement. Next, we will look at a similar set of examples covering higher earning workers and spouses.