The availability of spousal benefits has a big impact on the percentage of people’s pre-retirement income that is replaced by Social Security. In Part 1, we examined “average” income earning singles and couples, and compared combined retirement benefits and replacement rates. We saw how spousal benefits lifted a married couple’s combined benefit, but the impact could be very different depending on whether both spouses worked or not. Here we will look at higher earners and see somewhat similar outcomes. And, if you compare the earnings replacement rates of these higher earning singles and couples with the lower earning people in Part 1, you will note that as incomes rise, replacement rates go down. (In other words, the Social Security retirement system is progressive, in that lower income earners receive a higher return on their taxes paid in than upper earners.)

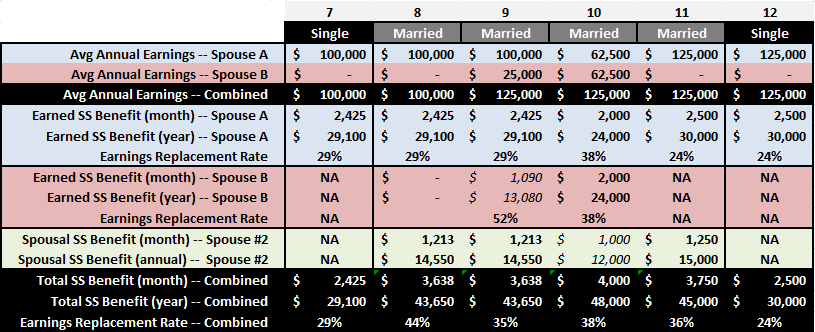

Below are six more singles and couples, these with “high” incomes of $100,000 to $125,000 per year. Again, two of the examples are single workers, while the other four examples are married couples. Two of the married couples have only one working spouse (couples #8 and #11), while the remaining two couples are comprised of dual earners paying into the Social Security system. (The examples assume all are retiring in 2012 at their full retirement age of 66, and they have not yet consulted with Table Rock Financial Planning on ways to make the most of their Social Security benefits.)

- Compare the single individual and the married couple, both making $100K/year (#7 and #8). Assuming their earnings have been the same over their working life, they have paid the same amount of taxes into the Social Security system. However, due to the availability of a spousal benefit, the married couple stands to receive a 50% higher combined benefit. The high earning single person will receive a benefit that replaces about 29% of his or her pre-retirement income, but the married couple will receive combined benefits amounting to a 44% replacement rate. Again, we see that the married wage earner potentially receives a significantly larger return on his or her contributions to the Social Security system. Fair or not, it is how the system is designed. And, if you understand the somewhat complex rules of the system, there are many perfectly legal and ethical opportunities for a married couple to further maximize the potential value of their combined Social Security benefits.

- Next, check out the situation with married couples #8 and #9. Only spouse A worked in couple #8, earning a healthy $100K/year. Couple #9 has an even higher combined income since each spouse worked, earning $100K and $25K respectively. As a result of these work histories, couple #8 has only one spouse with their own earned retirement benefit, but with couple #9 both spouses have earned benefits. Remarkably, even though couple #8 earned less money and paid less into the system, they will have the same combined Social Security benefit as the higher earning couple who both worked and paid more taxes. (Not to be critical, but who designed this system? Could it have been Congress?) Both couples’ dollar benefits are equal, but the lower earning couple #8 is receiving benefits that replace 44% of their pre-retirement income, but the higher earning couple #9 is receiving only 35%. What this means is that, all things being equal, couple #9 will need to save more money to maintain a comparable post-retirement lifestyle. Couple #9 appears to get a raw deal here…but, isn’t it always that way with entitlements? The other guy always seems to get a better deal from The System. Get used to it. Couple #9 can console themselves and improve their situation by going to a fee-only financial planner that understands the Social Security system.They have some opportunities to increase their income by coordinating their spousal benefits.

- Like couple #9, couples #10 and #11 also earned $125K, but taking different paths to that end. With couple #10, both spouses worked and contributed to the combined income equally. (I’m sure they hyphenated their names and shared the chores equally, also.) In couple #11, the income was earned the old fashioned way–entirely by spouse A. After seeing the previous examples, including the average earners in Part 1, you probably assume these three couples will have wildly different combined Social Security benefits. Not so–they are all pretty close, with replacement rates between 35% and 38% of their pre-retirement incomes. In Part 1, we saw how having the earnings concentrated with one spouse can lead to higher earning replacement rates. However, high earning couple #11 didn’t find that to be true. The reason is that high earning spouse A earned over the Social Security maximum taxable earnings over their career, limiting both their Social Security tax liability and their eventual benefit.

- Finally, let’s compare the two single individuals (#7 and #12). Even though #12 earned on average 25% more than #7, their retirement benefits are very close to the same. This is fair, since they both probably paid about the same amount of taxes into the system. The higher paid #12 likely earned over the Social Security maximum taxable earnings for entirety of their career, where #7 probably earned close to, but slightly below the limit. However, when you compare their replacement rates, the lower earning #7 fares somewhat better than the higher earning #12–29% versus 24%. The key point here is that both of these high earning single people receive a much lower replacement income from Social Security than their married counterparts (#8-#11), whose combined benefits replace 35% to 45% of the couples’ similar incomes. Also, the Social Security retirement benefits these high earning singles receive provide them with a much lower replacement income than the lower (or average) earning singles we saw in Part 1. Higher earners need to save more to replace their pre-retirement incomes than lower earners. And, if you are single, count on having to save even more to replace your income in retirement than your married friends. Otherwise, don’t fret about not having a companion to dine out or vacation with–you won’t be able to afford it anyway.

If you haven’t figured it out yet, the Social Security system is much more complicated than you first thought…if you ever bothered to give it a thought. And, this only scratches the surface. To sum up, here are a few key takeaways:

- If you are single person–save more for retirement.

- If you are a higher earner–save more for retirement.

- Everyone else–save more for retirement. (Just to be sure.)

Social Security benefits are a sizeable chunk of most American’s retirement incomes. Before you make the important decisions regarding when to start your benefits, or how to coordinate your benefits with your spouse, make sure you have an adequate understanding of your options. This is a great time to consult with a fee-only financial planner who understands the system, in order to make sure you are doing the most to maximize your personal long term financial security.