Financial Planning Blog

The availability of spousal benefits has a big impact on the percentage of people's pre-retirement income that is replaced by Social Security. In Part 1, we examined "average" income earning singles and couples, and compared combined retirement benefits and replacement rates. We saw how spousal benefits lifted a married couple's combined benefit, but the impact could be very different depending on whether both spouses worked or not. Here we will look at higher earners and see somewhat similar outcomes. And, if you compare the earnings replacement rates of these higher earning singles and couples with the lower earning people in Part 1, you will note that as incomes rise, replacement rates go down. (In other words, the Social Security retirement system is progressive, in that lower income earners receive a higher return on their taxes paid in than upper earners.)

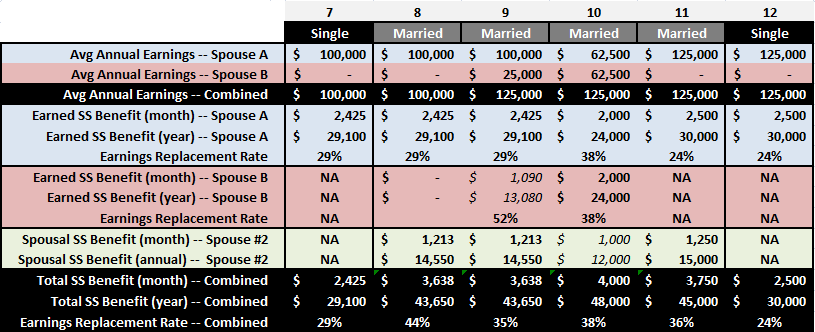

Below are six more singles and couples, these with "high" incomes of $100,000 to $125,000 per year. Again, two of the examples are single workers, while the other four examples are married couples. Two of the married couples have only one working spouse (couples #8 and #11), while the remaining two couples are comprised of dual earners paying into the Social Security system. (The examples assume all are retiring in 2012 at their full retirement age of 66, and they have not yet consulted with Table Rock Financial Planning on ways to make the most of their Social Security benefits.)

- Compare the single individual and the married couple, both making $100K/year (#7 and #8). Assuming their earnings have been the same over their working life, they have paid the same amount of taxes into the Social Security system. However, due to the availability of a spousal benefit, the married couple stands to receive a 50% higher combined benefit. The high earning single person will receive a benefit that replaces about 29% of his or her pre-retirement income, but the married couple will receive combined benefits amounting to a 44% replacement rate. Again, we see that the married wage earner potentially receives a significantly larger return on his or her contributions to the Social Security system. Fair or not, it is how the system is designed. And, if you understand the somewhat complex rules of the system, there are many perfectly legal and ethical opportunities for a married couple to further maximize the potential value of their combined Social Security benefits.

- Next, check out the situation with married couples #8 and #9. Only spouse A worked in couple #8, earning a healthy $100K/year. Couple #9 has an even higher combined income since each spouse worked, earning $100K and $25K respectively. As a result of these work histories, couple #8 has only one spouse with their own earned retirement benefit, but with couple #9 both spouses have earned benefits. Remarkably, even though couple #8 earned less money and paid less into the system, they will have the same combined Social Security benefit as the higher earning couple who both worked and paid more taxes. (Not to be critical, but who designed this system? Could it have been Congress?) Both couples' dollar benefits are equal, but the lower earning couple #8 is receiving benefits that replace 44% of their pre-retirement income, but the higher earning couple #9 is receiving only 35%. What this means is that, all things being equal, couple #9 will need to save more money to maintain a comparable post-retirement lifestyle. Couple #9 appears to get a raw deal here...but, isn't it always that way with entitlements? The other guy always seems to get a better deal from The System. Get used to it. Couple #9 can console themselves and improve their situation by going to a fee-only financial planner that understands the Social Security system.They have some opportunities to increase their income by coordinating their spousal benefits.

- Like couple #9, couples #10 and #11 also earned $125K, but taking different paths to that end. With couple #10, both spouses worked and contributed to the combined income equally. (I'm sure they hyphenated their names and shared the chores equally, also.) In couple #11, the income was earned the old fashioned way--entirely by spouse A. After seeing the previous examples, including the average earners in Part 1, you probably assume these three couples will have wildly different combined Social Security benefits. Not so--they are all pretty close, with replacement rates between 35% and 38% of their pre-retirement incomes. In Part 1, we saw how having the earnings concentrated with one spouse can lead to higher earning replacement rates. However, high earning couple #11 didn't find that to be true. The reason is that high earning spouse A earned over the Social Security maximum taxable earnings over their career, limiting both their Social Security tax liability and their eventual benefit.

- Finally, let's compare the two single individuals (#7 and #12). Even though #12 earned on average 25% more than #7, their retirement benefits are very close to the same. This is fair, since they both probably paid about the same amount of taxes into the system. The higher paid #12 likely earned over the Social Security maximum taxable earnings for entirety of their career, where #7 probably earned close to, but slightly below the limit. However, when you compare their replacement rates, the lower earning #7 fares somewhat better than the higher earning #12--29% versus 24%. The key point here is that both of these high earning single people receive a much lower replacement income from Social Security than their married counterparts (#8-#11), whose combined benefits replace 35% to 45% of the couples' similar incomes. Also, the Social Security retirement benefits these high earning singles receive provide them with a much lower replacement income than the lower (or average) earning singles we saw in Part 1. Higher earners need to save more to replace their pre-retirement incomes than lower earners. And, if you are single, count on having to save even more to replace your income in retirement than your married friends. Otherwise, don't fret about not having a companion to dine out or vacation with--you won't be able to afford it anyway.

If you haven't figured it out yet, the Social Security system is much more complicated than you first thought...if you ever bothered to give it a thought. And, this only scratches the surface. To sum up, here are a few key takeaways:

- If you are single person--save more for retirement.

- If you are a higher earner--save more for retirement.

- Everyone else--save more for retirement. (Just to be sure.)

Social Security benefits are a sizeable chunk of most American's retirement incomes. Before you make the important decisions regarding when to start your benefits, or how to coordinate your benefits with your spouse, make sure you have an adequate understanding of your options. This is a great time to consult with a fee-only financial planner who understands the system, in order to make sure you are doing the most to maximize your personal long term financial security.

In the previous post, the key rules regarding Social Security spousal benefits were introduced. Although most people are aware that a married worker's spouse can receive a retirement benefit off the worker's record, few appreciate exactly how much this influences the replacement income Social Security provides a family. Some examples will illustrate key points about how marriage, the distribution of income between spouses, and the availability of spousal benefits impact the amount of benefits received from the Social Security system.

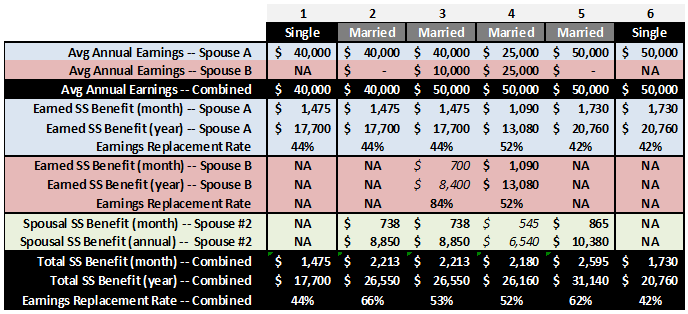

Below are six different situations with workers making an "average" income of $40,000 to $50,000 per year. In two of the examples the workers are unmarried, with the other four comprised of married couples. In two of the married couples, one spouse does not work. In the other two married couples, both spouses have earnings covered by Social Security. (It is assumed all are retiring in 2012 at their full retirement age of 66. None of the individuals have been reading financial planning blogs suggesting they wait until 70.)

- Compare the single individual and the married couple, both making $40K/year (#1 and #2). Even though earnings and taxes paid into the Social Security system are the same, the married couple stands to receive a considerable amount more from the system. Due to the availability of the spousal benefit (equal to 50% of the worker's primary insurance amount), the married couple will receive benefits replacing 66% of their pre-retirement income, compared to the single person replacing only 44%. Is this fair? I suppose it depends on whether you are the single person, or part of the married couple.This is a prime example of how Social Security is family oriented.

- Now compare married couple #2 with average earnings of $40K and married couple #3 with average earnings of $50K per year. Notice that spouse B of couple #3 contributed $10K/year of their earnings, and earned their own personal benefit of $700/month. However, spouse B's earned retirement benefit is lower than the $738/month spousal benefit they are eligible for. The Social Security Administration (SSA) will supplement spouse B's earned benefit to bring it up to the $738 spousal benefit. Note that the combined benefits of couples #2 and #3 are equal, even though couple #3 made 25% more money, and presumably paid 25% more into the system. The earnings replacement rate of the lower earning couple #2 is 66%, but drops to only 53% for couple #3. Unfortunately, that part time job for couple #3 didn't contribute as much to their retirement as they had anticipated. Hopefully, they saved a good part of spouse B's earnings.

- Similar to couple #3, couples #4 and #5 also earned $50K, but did so in different ways. In couple #5, only spouse A worked and earned a benefit. In couple #4, both spouses contributed equally to the family finances, both earning $25K/year. Both earn an equal benefit from Social Security, which is higher than the spousal benefit they would be eligible for off the other spouse's record. Note that couple #4, where both spouses worked, has an earnings replacement rate of 52%--slightly lower than couple #3. Couple #5, where only one spouse worked, has a remarkably higher combined earnings replacement rate of 62%--about $400/month more than couples #3 and #4 where both spouses worked. How earnings are split between spouses makes a surprising difference. For these average earning couples, having the earnings concentrated with one spouse leads to higher earnings replacement rates. However, having earnings concentrated with one spouse does not necessarily lead to higher benefits as incomes rise, as you'll see in Part 2.

- Finally, compare the two single individuals (#1 and #6). As expected, the one making $50K/year has earned a higher retirement benefit than the one making $40K/year. However, notice that the earnings replacement rate is a bit lower for the higher earning worker as compared to the lower earning worker (42% versus 44%). Even though Social Security retirement benefits increase with higher average lifetime earnings, the amount of pre-retirement income that is replaced by Social Security significantly declines. As you'll see in Part 2, the replacement rate for a single worker averaging $125K/year drops to under 25%. This is just one way that Social Security benefits are already "means tested"--where higher earning people pay more and/or receive less from the system. Most will agree this is somewhat appropriate, but it is important to consider how much "means testing" is currently in the system before calling for more.

These examples give you an idea of how different factors determine the amount of replacement income people can expect from Social Security. Obviously, it makes a big difference for an individual or couple whether their Social Security benefits will replace 20% or 60% of their pre-retirement income. After all, they need a plan to cover the rest or else face a severe drop in lifestyle in retirement. Next, we will look at a similar set of examples covering higher earning workers and spouses.

One of the more thoughtful and "women friendly" characteristics of the Social Security system is the availability of various types of spousal benefits. These constitute some of the more complex features of the retirement benefit system, but also provide some fruitful planning opportunities.

When the Social Security Act was passed back in 1935, the initial provision of monthly benefits for retirees was set to begin in 1942. This allowed at least a small number of years for payroll taxes to build up a reserve. However, in 1939 the system was amended to pull in the start of monthly payments to 1940, and also added benefits for wives, widows, and dependent children of covered workers. In one fell swoop, Congress set the tone for the next several decades and established two important Social Security trends:

- It is easier to add additional Social Security benefits first, and let others worry about paying for them later. But, hey, before we complain about too much about Congress doing this, we should admit that this simply reflects the will and the behavior of the "average" American.

- The Social Security System is about enhancing the economic security of families, not just individuals. Since the common family model of that time was a working father and a stay-at-home mother, it was important to also ensure the economic well-being of the non-working spouse and children. Interestingly, spousal benefits were initially provided only for women, not for men. (This was changed after Ozzie Nelson organized a massive march on Washington by stay-at-home dads in the mid 1950s.) As a result of spousal and dependent benefits, married workers and their families generally stand to receive more out of the Social Security System than single workers.

Here are the key rules regarding Social Security spousal benefits:

- The spousal benefit is calculated off the retired workers primary insurance amount (PIA), which is the worker's earned retirement benefit at full retirement age (FRA). Full retirement age is 66 for workers born between 1943 and 1954, but transitions to age 67 for younger workers.

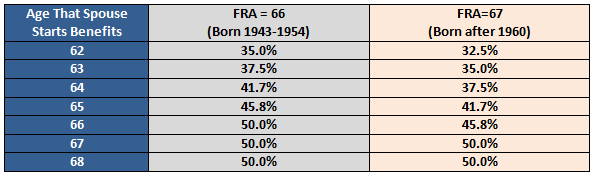

- A spouse is eligible for up to 50% of the retired worker's PIA, but the exact amount depends on when the spouse (not the retired worker) files for monthly benefits. At the spouse's full retirement age, the benefit is 50% of their husband or wife's PIA. However, if benefits are taken earlier than FRA they are reduced by 25/36 of one percent for each of the first 36 months. After 36 months, the reduction is only 15/36 of one percent per month. The table below shows the percentage of the worker's PIA spouses can expect, depending on when they start benefits, and whether their own FRA is at age 66 or age 67.

- Waiting beyond FRA does not increase the spousal benefit. This is in contrast to a worker's own benefit that can grow considerably from FRA to age 70 with delayed retirement credits. Even if the worker delays until age 70, maximizing his or her personal benefit with delayed credits, the spousal benefit will not increase--it is always calculated off the worker's PIA. Conversely, the spousal benefit is not reduced if the worker chooses to claim a reduced benefit as early as age 62.

- Age 62 is the earliest a person can apply for spousal benefits, unless they are caring for a "qualifying child"--i.e. a dependent child under the age of 16, or one receiving Social Security disability benefits. Unlike normal spousal benefits, if the spouse is caring for a qualifying child the benefit is not reduced for early receipt.

- Generally, a spouse must be married to the worker for at least one continuous year prior to applying for benefits. This requirement is waived if the spouse is already receiving survivor benefits or spousal benefits off an ex-spouse's work record.

- The spouse cannot claim benefits until the worker is "entitled" to benefits. In other words, the worker with the earned benefit must either be receiving benefits, or have filed for, but suspended receipt of his or her benefit. (More on why someone would the "claim and suspend" later.)

- If the spouse is working and has not yet hit their FRA, any spousal benefits they receive may be reduced if they exceed Social Security earnings limitations ($14,640 for 2012.)

In the next post we will look at some of the implications of the spousal benefits, along with how cultural trends will impact the amount of "replacement income" that Social Security will likely provide future individuals and families. And, if you are wondering about how retirement benefits work for divorced spouses and widows (and widowers), these will also be examined in coming weeks. Finally, we will look at some of the planning opportunities provided by the very thoughtful, but very complex Social Security retirement system.

Next page: Disclosures